View Procedure

| Procedure Name | Customs procedure for export declaration in electronic form (e-Declaration) and clearance on the Viet Nam Automated Cargo Clearance System (VNACCS System) |

|---|

| Description |

|

Category

|

Customs Clearance Procedure

|

|

Responsible Agency

|

General Department of Customs

Address: Block E3 - Duong Dinh Nghe street, Yen Hoa, Cau Giay, Hanoi, Vietnam

Phone: (+844) 39440833 (ext: 8623)

Email: webmaster@customs.gov.vn

|

|

Legal Basis of the Procedure

|

- Decree No. 08/2015/ND-CP of the Government dated January 21, 2015 providing specific provisions and guidance on enforcement of the Customs Law regarding customs procedures, examination, supervision and control procedures.

- Circular 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

- Circular 274/2016/TT-BTC on the rate, collection, submission, management and use of the customs fees and the charges on goods and vehicles in transit.

|

|

Processing time

|

- Within 08 working hours for partly physical examination of the goods

- Within 02 working days for fully physical examination of the goods

|

|

Fee

|

VND 20,000

|

Required Documents

|

No.

|

Type of documents

|

Note

|

|

1

|

Electronic Export Customs Declaration (E-Form HQ/2015/XK)

|

|

|

2

|

Annex Form HQ/2015/PLXK

|

|

Required Documents if the trader receives feedback for Yellow Channel

|

No.

|

Type of documents

|

Note

|

|

1

|

Bill of lading

|

|

|

2

|

Packing list

|

|

|

3

|

Contract

|

|

|

4

|

Export Permit

|

(if any)

|

|

5

|

Invoice

|

|

|

6

|

Specialized Inspection Certificate

|

(if any)

|

|

7

|

Certificate of Origin

|

(if any)

|

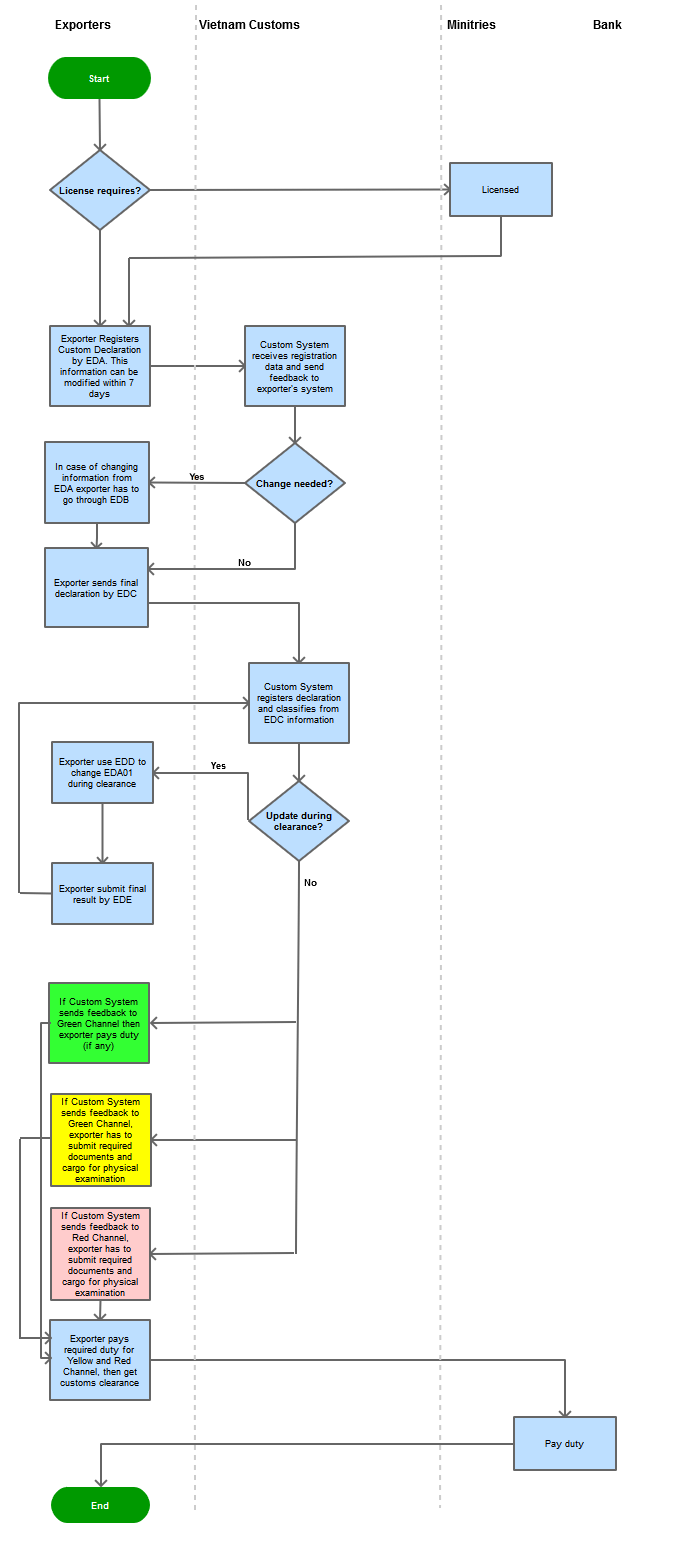

Process Steps

|

Step 1

Customs Declaration Submission

|

1.1 Registration

The exporter shall submit the customs declaration on the VNACCS System by following the EDA procedure. Registered information will be stored and can be changed/modified up to 07 days.

|

|

1.2 Information Change

In case of changing information from the EDA, the exporter shall go through the EDB procedure to change the information (if any).

|

|

1.3 Submission of Final Declaration

The exporter shall submit the final registered customs declaration on the VNACCS System by following the EDC procedure.

|

|

Step 2

Feedback from the VNACCS System

|

2.1 Feedback for Green Channel

If the VNACCS System sends feedback for Green Channel, the importer has to pay duty (if any) and get approval for customs clearance.

|

|

2.2 Feedback for Yellow Channel

If the VNACCS System sends feedback for Yellow Channel, the exporter has to submit the following documents for customs verification

(i) Bill of lading

(ii) Packing list

(iii) Contract

(iv) Export Permit (if any)

(v) Invoice

(vi) Specialized Inspection Certificate (if any)

(vii) Certificate of Origin (if any)

|

|

2.3 Feedback for Red Channel

If the VNACCS System sends feedback for Red Channel, the exporter has to submit the above documents and cargo for physical examination.

2.4 Payment of tax/duty and charge/fee by the Importer

|

|

Step 3

Approval for Customs Clearance

|

The exporter gets approval for customs clearance

|

Process Map:

|

|---|

| Category | Procedure |

|---|

Please customize this view

This procedure apply to theses Measures.