View Procedure

| Procedure Name | Procedure for separate guarantee according to Article 43 Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance |

|---|

| Description |

|

Category

|

Customs Clearance Procedure

|

|

Responsible Agency

|

Provincial Customs Department

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

-

Law on Export and Import Duties No. 107/2016/QH13;

-

Decree No. 134/2016/ND-CP dated September 1,2016

-

Circular No. 38/2015/TT-BTC dated 3/25/2015 of the Ministry of Finance on customs procedures; customs supervision and inspection; export tax, import tax, and tax administration of exported or imported goods.

|

|

Processing time

|

- Before or at the time of following procedures for declaration of exported/imported goods before clearance or release of goods

|

|

Fee

|

|

Required documents

|

No

|

Type of documents

|

|

1

|

Letter of specific guarantee of a credit institution

|

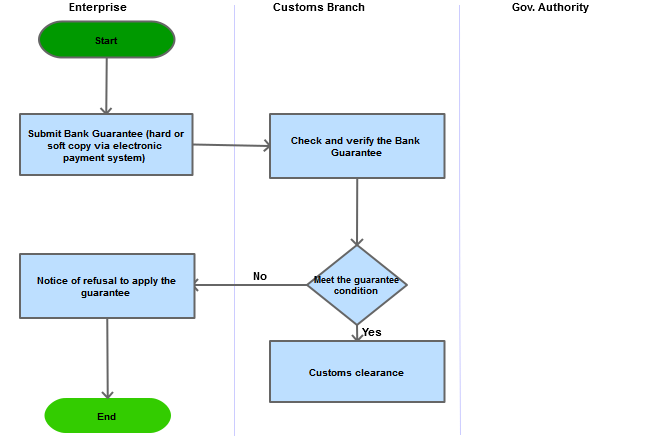

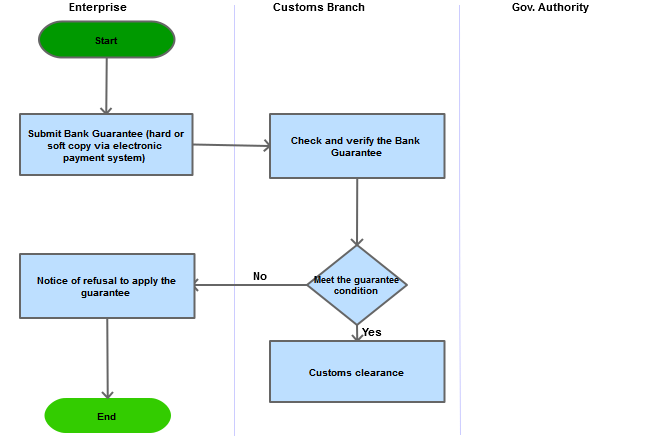

Process Steps

|

No

|

Contents

|

|

Step 1

|

If tax guarantee is provided, the taxpayer shall submit the letter of guarantee written by the guarantor to the customs authority where the customs declaration has been registered before customs clearance or release of goods while following procedures for export or import of a shipment, using the Form No. 05/TBLR/TXNK in Appendix VI enclosed with Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance.

In case of electronic guarantees provided via commercial banks that have entered into agreements on tax collection with the General Department of Customs, the guarantor bank shall send information on the letter of guarantee via the Electronic Payment System on the Electronic Payment Portal of the General Department of Customs before customs clearance or release of goods.

|

|

Step 2

|

The customs authority shall inspect the fulfillment of conditions for guarantee prescribed in Clause 2 Article 43 Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance, and grant customs clearance or release of goods if all conditions are fulfilled.

+ In case of electronic guarantees provided via commercial banks that have entered into agreements on tax collection with the General Department of Customs: Upon receipt of information about the amount of guaranteed tax at a commercial bank via the Electronic Payment System on the Electronic Payment Portal of the General Department of Customs, the customs authority shall update it on the database of the General Department of Customs and grant customs clearance of goods.

+ If any of the guarantee conditions is not satisfied, the customs authority shall notify the taxpayer of the refusal of tax guarantee.

+ The deadline for separate guarantee shall not be later than the deadline prescribed in Clause 1 Article 9 of the Law on Export and Import Duties No. 107/2016/QH13.

|

Flow chat

|

|---|

| Category | Procedure |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |