View Procedure

| Procedure Name | Procedure for joint guarantee according to Article 43 Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance |

|---|

| Description |

|

Category

|

Customs Clearance Procedure

|

|

Responsible Agency

|

Provincial Customs Department

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

-

Law on Export and Import Duties No. 107/2016/QH13

-

Decree No.134/2016/ND-CP dated September 1,2016

-

Circular No. 38/2015/TT-BTC dated 3/25/2015 of the Ministry of Finance on customs procedures; customs supervision and inspection; export tax, import tax, and tax administration of exported or imported goods.

|

|

Processing time

|

- Before or at the time of registration of import-export declaration

|

|

Fee

|

|

Required documents

|

No

|

Type of documents

|

Note

|

|

1

|

Written request for permission for joint guarantee of imported goods

|

01 original copy

|

|

2

|

Letter of general guarantee of a credit institution

|

01 original copy

|

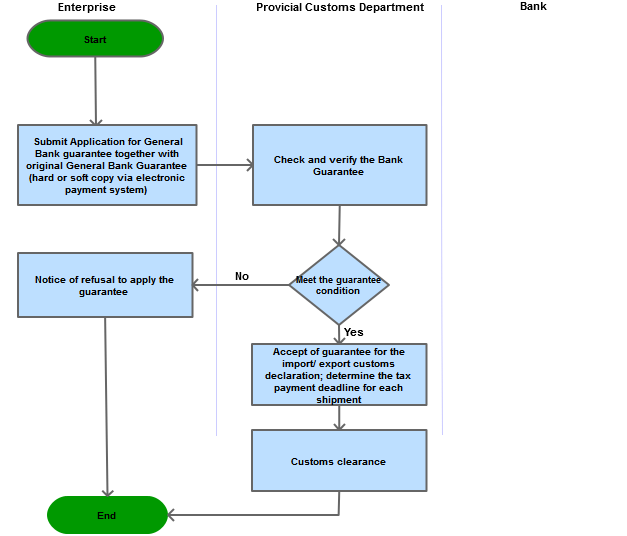

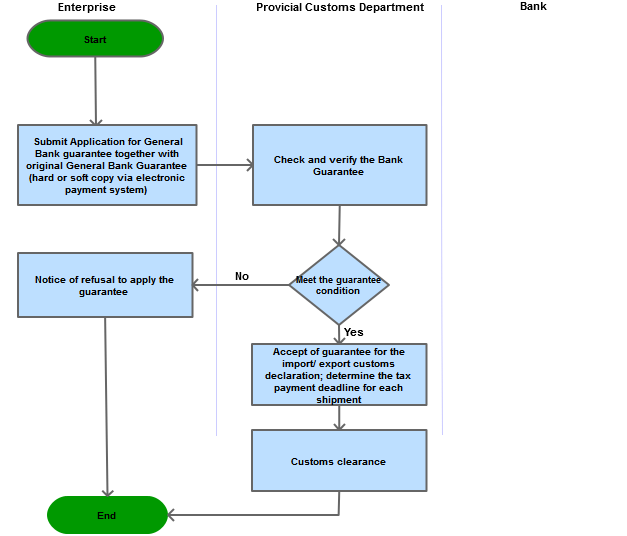

Process Steps

|

No

|

Contents

|

|

Step 1

|

Before initiating procedures for export or import, the taxpayer shall send a written request for permission for joint guarantee of imported goods using the Form No. 06A/DDNBLC/TXNK and a letter of joint guarantee using the Form No. 06/TBLR/TXNK in Appendix VI enclosed with Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance to the Customs Authority where the customs declaration is registered;

In case of electronic guarantees provided via commercial banks that have entered into agreements on tax collection with the General Department of Customs, the guarantor bank shall send information on the letter of guarantee via the Electronic Payment System on the Electronic Payment Portal of the General Department of Customs before customs clearance or release of goods.

|

|

Step 2

|

The customs authority shall inspect the fulfillment of conditions for guarantee prescribed in Clause 2 Article 43 Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance. If all conditions are satisfied, the customs authority shall accept the joint guarantee for multiple declarations of imported/exported goods which are registered during the guarantee period written on the letter of guarantee, and determine the deadline for paying tax on each shipment according to the guarantee period and grant customs clearance or release of goods. If any of the guarantee conditions is not satisfied, the customs authority shall notify the taxpayer of the refusal of tax guarantee.

|

|

|---|

| Category | Procedure |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |