| Description |

|

Category

|

Customs Clearance Procedure

|

|

Responsible Agency

|

General Department of Customs

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

- Law on Tax Administration No. 78/2006/QH11 dated November 29, 2006;

- Law No. 21/2012/QH13 dated November 20, 2012 on amendments to the Law on Tax Administration;

- Law No. 71/2014/QH13 on amendments to the tax laws;

- Decree No. 83/2013/ND-CP dated July 22, 2013 of the Government on providing specific provisions on implementation of several articles of the Law on Tax Administration and the Law on Amendment and Supplement to several articles of the Law on Tax Administration;

- Decree No. 12/2015/ND-CP dated February 12, 2015 on providing specific provisions on implementation of the Law on Amendment and Supplement to several articles of the Law on Taxation and Amendment and Supplement to several articles of Decrees on Taxation;

- Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

|

|

Processing time

|

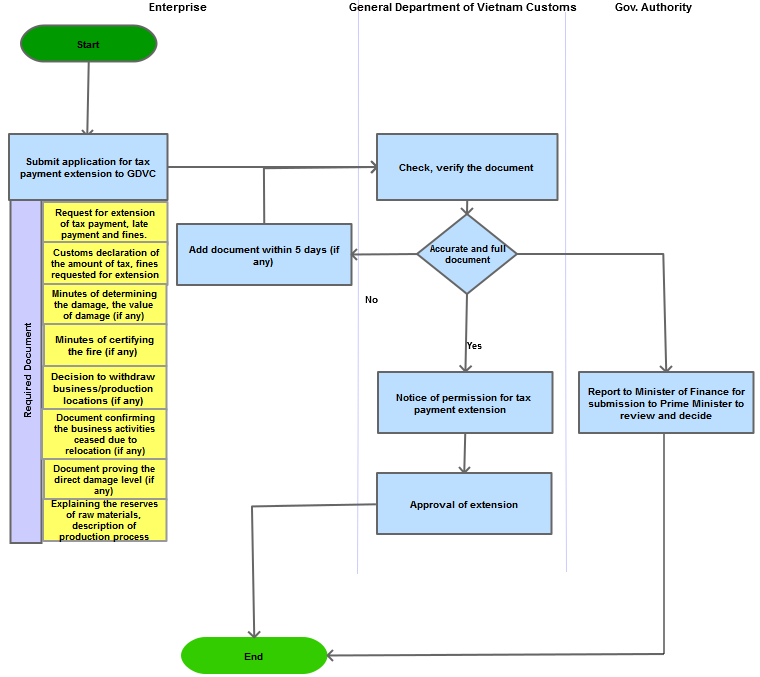

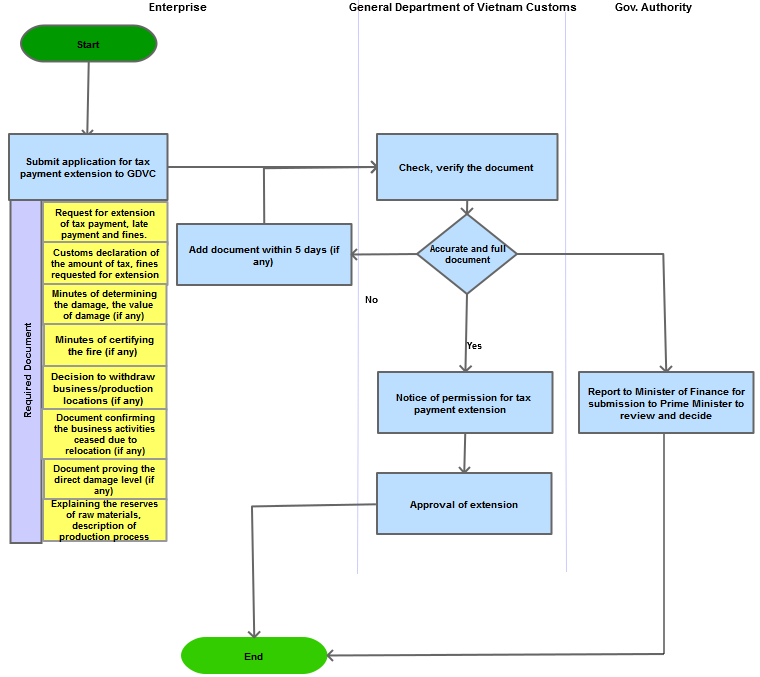

- Within 03 working days from the receipt of the dossier, if the dossier is not complete or valid, the General Department of Customs shall make a request for the taxpayer to complete the dossier.

- Within 05 working days from the receipt of the written request, if the taxpayer fails to complete the dossier, he/she shall not be entitled to tax deferral under applicable provisions;

- Within 10 working days from the receipt of the dossier, if the dossier is satisfactory, accurate and adequate, the General Department of Customs shall issue a written notice of approval of tax deferral and send it to the taxpayer.

In other special difficult cases due to inevitable causes, the General Department of Customs shall submit the dossier to the Minister of Finance for his/her discretion to submit it to the Prime Minister for consideration and decision

|

|

Fee

|

Not applied

|

Required documents

|

No

|

Type of documents

|

Note

|

|

1

|

A written request for deferral of tax, late payment interest and fines, clearly stating the reason and the amount of deferrable tax, late payment interest, fines; if the amount of deferrable tax, late payment interest, fines requested for deferral is on various customs declarations, those customs declarations shall be listed, together with commitments of accurate statements and right dossiers of request for deferral; plans and commitments of payment of the amount of deferrable tax, late payment interest, fines requested for deferral..

|

01 original copy

|

|

2

|

The customs declaration of the amount of deferrable tax, late payment interest, fines requested for deferral (except for the case the declarant follows electronic customs procedures); tax declaration of the deferrable tax, late payment interest, fines requested for deferral: 01 photocopy; The amount of tax, late payment interest, fines to be paid at the time of occurrence of causes

|

01 original copy

|

|

3

|

For cases stipulated in Point a Clause 1 Article 31 of Decree No. 83/2013/ND-CP as amended and supplemented in Clause 8 Article 5 of Decree No. 12/2015/ND-CP, the following papers shall be added:

|

A record of extent and value of physical damages issued by the competent agency;

|

|

|

A record of the fire issued by the fire fighting police authority of the locality where the fire occurred; a written certification of the People's Committee of the commune, ward, town where the natural disaster or incident occurred.

The above papers shall be made immediately after the occurrence of the natural disaster or incident

|

01 original copy

|

|

4

|

For cases stipulated in Point b Clause 1 Article 31 of Decree No. 83/2013/ND-CP as amended and supplemented in Clause 8 Article 5 of Decree No. 12/2015/ND-CP, the following papers shall be added:

|

A written decision of withdrawal of the production and business location issued by the competent agency over the business's former production location in accordance with provisions of applicable laws, not subject to relocation of production according to the purpose and request of the business

|

01 photocopy

|

|

A written certification of the People's Committee of the local commune, ward, town of the suspension of production activities due to the relocation

|

01 original copy

|

|

Documents proving the extent and value of direct damages due to the business relocation: to be determined on the basis of records, documents and applicable regulations of law, including: the remaining irrecoverable value of dismantled houses, workshops, warehouses (total cost after deducting the depreciation costs), costs of dismantling equipment, workshops at the former location, costs of transport and installation at the new location (after deducting recovery costs), costs of payments to workers due to the suspension of working activities (if any); for complicated cases, involving other technical or economic aspects, there must be a written request for opinions of specialized agencies.

|

01 original copy |

| 5 |

For other special difficult cases as stipulated in Point d Clause 1 Article 31 of Decree No. 83/2013/ND-CP as amended and supplemented in Clause 8 Article 5 of Decree No. 12/2015/ND-CP, the following papers shall be added: |

Documents relating to inevitable causes of failure to pay tax on schedule due to special difficulties |

|

Process Steps

|

No

|

Contents

|

|

Step 1

|

The taxpayer shall submit the dossier of request for tax deferral to the General Department of Customs for examination. The General Department of Customs shall receive and examine the dossier of request for tax deferral and inform the taxpayer of the result of settlement.

|

|

Step 2

|

In other special difficult cases due to inevitable causes, the General Department of Customs shall receive the dossier, submit the dossier to the Minister of Finance for his/her discretion to submit it to the Prime Minister for consideration and decision.

|

Flow chat

|

|---|