View Procedure

| Procedure Name | Procedures applied to payment of tax arrears in installments as prescribed in Clause 25, Article 1 of Law Amending and Supplementing a Number of Articles of the Law on Tax Administration... for tax arrears incurred at least 02 Customs Departments or above | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Description |

Required documents

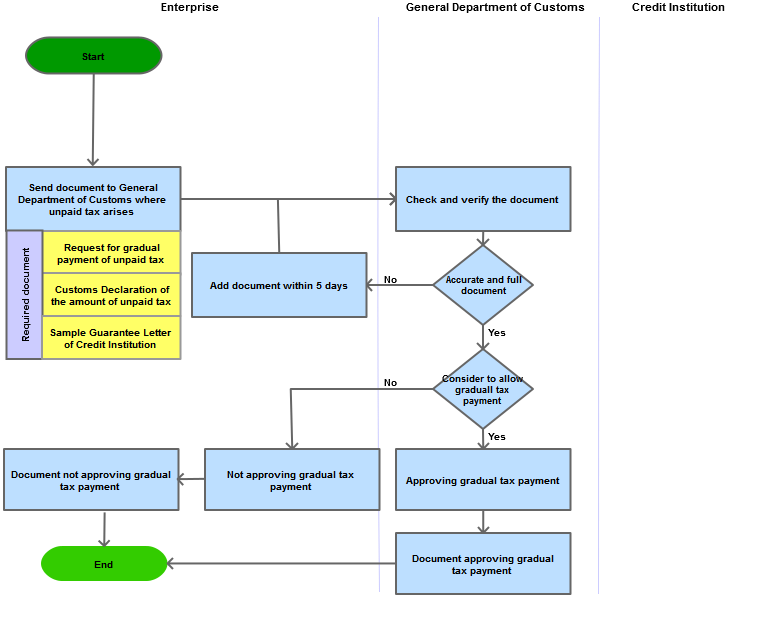

Process Steps

Requirements and conditions in following administrative procedures: Those meeting conditions specified in Clauses 1, 2 of Article 39 Decree No. 83/2013/ND-CP dated July 22, 2013 of the Government may pay tax arrears in installments over no more than 12 months from the effective day of the decision on taxation enforcement: - The taxpayer is not able to pay the tax arrears one time may pay them in installments over no more than 12 months from the effective day of the decision on taxation enforcement, provided that taxpayers has the tax arrears guaranteed by a credit institution, and a commitment to pay tax arrears and late payment interest to the state budget is made. - The taxpayer must comply with the commitment to evenly divide the tax arrears to pay them in installments every month. - For exported goods and imported goods, the taxpayer must pay the tax on the shipment that is undergoing customs procedures before customs clearance, or must be guaranteed by a credit institution, apart from the aforesaid conditions. - While paying the tax arrears in installments, the taxpayer still have to pay late payment interest at 0.03% of the tax arrears per day. - The taxpayer must pay the tax and late payment interest in full. If the taxpayer fails to pay tax arrears and late payment interest on schedule, the guaranteeing organization shall pay them on behalf of the taxpayer, including the tax arrears, late payment interest at 0.03% of tax arrears per day. Flow chat

| ||||||||||||||||||||||||||||

| Category | Procedure |

| Title | Description | Created Date | Updated Date | Issued By |  |

|---|---|---|---|---|---|

| Form no. 05/TBLR/TXNK | Form no. 05/TBLR/TXNK, particular Bank Guarantee | 17-04-2016 | 17-04-2016 | Department of Vietnam Customs | |

| Form no. 06/TBLC/TXNK | Form no. 06/TBLC/TXNK, General Bank Guaratee | 17-04-2016 | 17-04-2016 | Department of Vietnam Customs |

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

|---|---|---|---|---|---|---|---|

| No results found. | |||||||