View Procedure

| Procedure Name | Procedure for certification of fulfillment of tax obligations |

|---|

| Description |

|

Category

|

Customs Clearance Procedure

|

|

Responsible Agency

|

General Department of Vietnam Customs

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

-

Law on Tax Administration No. 78/2006/QH11;

-

Law Amending and Supplementing a number of articles of Law No. 21/2012/QH13 on Handling of Administrative Violations;

-

Decree No. 83/2013/ND-CP dated 7/22/2013 of the Government detailing a number of articles of the Law on Tax Administration and the Law Amending and Supplementing a Number of Articles of the Law on Tax Administration;

-

Circular No. 38/2015/TT-BTC dated 3/25/2015 of the Ministry of Finance on customs procedures; customs supervision and inspection; export tax, import tax, and tax administration of exported or imported goods.

|

|

Processing time

|

05 working days from day of receipt of sufficient valid document

|

|

Fee

|

Not applied

|

Required documents

|

No

|

Type of documents

|

Note

|

|

1

|

A written request for certification of fulfillment of tax obligations signed and sealed by the representative at law of the business (if the certification is signed by an authorized representative, a written authorization of the representative at law shall be presented) with the following contents:

The taxpayer's full name and tax code;

Contents and objectives of the requested certification;

Documents proving contents of the requested certification.

|

01 original copy

|

|

2

|

Certificate of Business Registration (or Certificate of Investment, Certificate of Business Establishment; or other papers of equivalent validity relating to business establishment)

|

01 certified photocopy

|

|

3

|

Certificate of Registration of Tax Code

|

01 certified photocopy

|

|

4

|

Other documents relating to the certified contents

|

01 certified photocopy

|

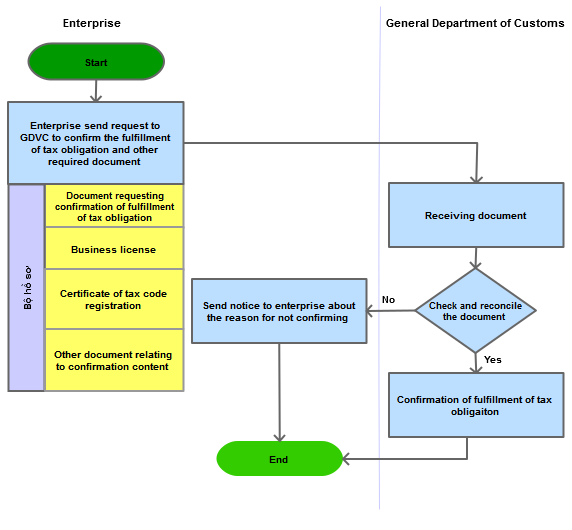

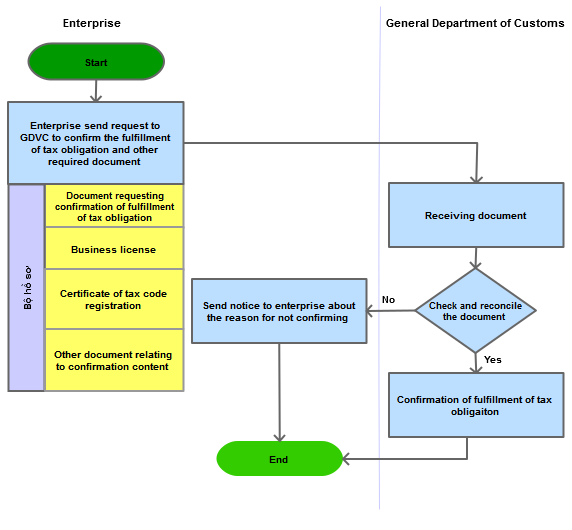

Process Steps

|

No

|

Contents

|

|

Step 1

|

The taxpayer shall submit a written request for certification of fulfillment of tax obligations to the General Department of Customs, together with prescribed documents

|

|

Step 2

|

The General Department of Customs shall receive and examine the dossier; on the basis of the accounting system, it shall make decisions on certification and notify the taxpayer of the result.

|

Flow chat

|

|---|

| Category | Procedure |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |