News

Agricultural products importers have signs of VAT evasion with amounts of dozens of billions of VND

Summary

Updated on : 01-08-2017

VCN - Suspecting that many agricultural products enterprises had extraordinary signs, Customs authorities reviewed and discovered acts of VAT evasion with amounts of dozens of billions of VND.

From extraordinary signs

Agricultural, forestry and fishery products which have not yet been processed or have been preliminary processed (peeled, dried etc) at import stage are not subject to VAT according to the provision in Clause 1, Article 5 of VAT Law. However, enterprises must declare and pay VAT for consumption of these imported products at the stage of trade with the tax rate and tax declaration and payment method in accordance with buying and selling entities.

Imports of agricultural, forestry and fishery products which have not yet been processed in to other products or have been processed such as: fruits of all kinds, dried onion, garlic, bean, peanut to Vietnam and then sold to other business households, individuals and organizations (which are not enterprises declaring and paying tax according to deduction method) must declare and pay VAT with tax rate of 5% in line with Circular No. 219/2013/TT-BTC dated December 31, 2013 of the Ministry of Finance guiding the implementation of VAT Law and Official Dispatch No. 385/BTC-CST dated January 9, 2014, of the Ministry of Finance sent to people’s committees and tax departments in provinces and central runs cities on VAT for agricultural, forestry and fishery products.

In order to facilitate enterprises, over the past time, Customs authorities and Tax authorities have applied IT in their operations. Accordingly, enterprises shall use digital signatures to implement Customs declaration and tax declaration electronically via the internet; shall print, make a receipt and declare and pay tax by themselves; and be not be required to submit a list of goods and services sold or bought in the declaration periods. Taking these advantages, some enterprises import agricultural, forestry and fishery products from China without process and sold them directly business households or individuals. According to the law, when selling to business households or individuals, those products are subject to tax declaration and payment but enterprises do not declare to local tax authorities for tax evasion and fraud.

According to statistics from Customs, in 2016, Tan Thanh border gate had 93 enterprises importing agricultural products with a total import turnover of over 2,739 billion VND. Imported goods were mainly direct consumer goods such as orange, mandarin orange, pear, apple, dried onion, dried garlic, onion, potato. If selling the whole agricultural products to business households and individuals, importing enterprises must declare and pay VAT at the stage of trade with the tax rate of 5%, equivalent to 137 billion VND

Finding extraordinary signs in business operations of some enterprises, the Tan Thanh border Customs Branch monitored, reviewed and verified 93 enterprises. Thereby, discovering that 34 of 93 enterprises did not declare trading transactions in the tax period with a total value of over 1,152 billion VND and 8 enterprises were suspected of VAT fraud with an amount of more than 53 billion VND. At the same time, 28of 93 enterprises declared goods and services sold with a tax rate of 5% in the same or larger value of the imported products. However, most VAT declaration dossiers of enterprises did not include a list of invoices, there was no basis to identify kind of goods and services; buyers which are subject to tax declaration or not; and the VAT rate.

To investigation

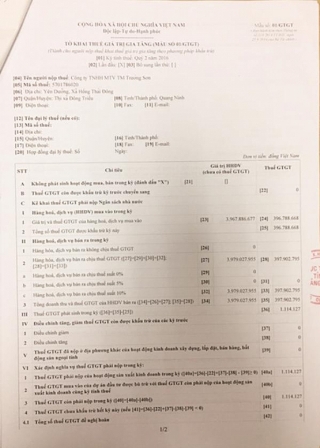

In order to fight and handle acts of VAT evasion and fraud of agricultural, forestry and fishery products importers, the Customs authority had a specialized investigation for two enterprises with signs of violations Truong Son Company Limited (Tax code 5701786020, address: Hong Thai Dong commune, Dong Trieu town, Quang Ninh province) and Lang Son Fisheries Agriculture Forestry Import Export Company (Tax code 0201573096, address: No. 20, Group 6, Cat Ba, Hai Phong city).

As a result, in 2016, Truong Son company limited registered 1,743 Customs declarations for imports of dried onion, dried garlic, potato, orange, mandarin orange, pear from China under A11 model (import for consumer business) with a total value of more than 249 billion VND. All products were entitled to import duty rate of 0%, but the company directly sold to business individuals and households with a cash payment, without sales contracts, invoices and tax declaration and payment to the local tax branch with a tax amount of 12.4 billion VND.

According to Certificate of business registration, the company headquartered at Hong Thai Dong commune, Dong Trieu town, Quang Ninh province, but when Customs implemented the verification at the locality, representative of the Hong Thai Dong commune’s people’s committee confirmed that the company had never existed in the commune. Furthermore, Director of the company Mac Truong Son had left the residence place. Due to not finding the director, Tax Branch of Dong Trieu town had no choice but issuing a notice to block receipts of this company

Similarly, Lang Son Fisheries Agriculture Forestry Import Export Company had evaded a great VAT amount of up to 23 billion VND.

The Customs statistics showed that in 2015, Lang Son Fisheries Agriculture Forestry Import Export Company registered 497 import declarations with a total value of 139 billion VND and 2,514 import declarations of dried onion, dried garlic, potato, onion, orange, mandarin orange and pear from China with a total value of 232 billion VND. If directly selling these products, the company must declare and pay VAT with an amount of over 23 billion VND.

Verifying the company, the Customs authority discovered that director of the company was a person whose name was borrowed and did not engage in company’s operation.

As assessed by the Customs authority, currently, bogus companies to import agricultural products to evade VAT are not established separately. Through reviews of the Customs Investigation and Anti-Smuggling Department under the General Department of Vietnam Customs, in 2016 only, 34 agricultural products importers did not declare and pay VAT to the domestic tax authorities with total value of up to 1,152 billion VNd

For above two companies, the Vietnam Customs is considering to investigate and handle according to the law.

Customs newspaper will continue to inform the case.

|

Article 200 of Criminal Code on Offences related to tax evasion stipulates: 1. Any person who commits any of the following acts of tax evasion with an amount of tax evaded from 100 million VND to under 300 million VND or with an amount of tax evaded under 100 million VND despite the fact that he/she previously incurred a civil penalty for the tax evasion or has a previous conviction for any of the offences specified in Article 188, 189, 190, 191, 192, 193, 194, 195, 196, 202, 248, 249, 250, 251, 252, 253, 254, 304, 305, 306, 309 and 311 hereof which has not been expunged, shall be liable to a fine of from 100 million VND to 500 million VND or face a penalty of 03 - 24 months' imprisonment; 2. Any person who commits any of the following cases shall carry a fine of from 500 million VND to 1,500 million VND or a penalty of 01 - 03 years' imprisonment 3. If the evaded tax is VND 1,000,000,000 or over, the offender shall be liable to a fine of from 1,500 million VND to 4,500 million or face a penalty of 02 - 07 years' imprisonment. |

By Dao Le/ Huyen Trang

Most Recent News

| Title | Category | Created On |

|---|---|---|

| Hội nghị Đối thoại về Quản lý Rủi ro Kiểm soát Thương mại Chiến lược | News | 2026-01-19 14:30:37 |

| Hội nghị Đối thoại về Quản lý Rủi ro Kiểm soát Thương mại Chiến lược | News | 2026-01-19 14:30:33 |

| The Department of Viet Nam Customs signed a Statement of Intent to enhance cooperation with the Australian Border Force | News | 2025-12-18 15:40:33 |

| The Department of Viet Nam Customs held a working meeting with the high-level delegation of the ASEAN-Europe Business Council and the European Business Association in Viet Nam | News | 2025-12-17 15:22:59 |

| Cục Hải quan Việt Nam tiếp và làm việc với Phái đoàn cấp cao của Hội đồng kinh doanh ASEAN - Châu Âu và Hiệp hội doanh nghiệp châu Âu tại Việt Nam | News | 2025-12-11 14:39:37 |

Search All News

|

A Quick Intro |

Search Trade Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feature Information

|

|

|

|

|

|

|

|

|

|

|

Information & Articles

|

|

|

|

|

|

|

|

|

|

|

|

Contact Us! If you cannot find what you require in this website please feel free to contact us. Click here to send us a message >>>

|