News

Receiving consultations on Law amending of 5 laws on tax until 29/8 /2017

Summary

Updated on : 25-08-2017

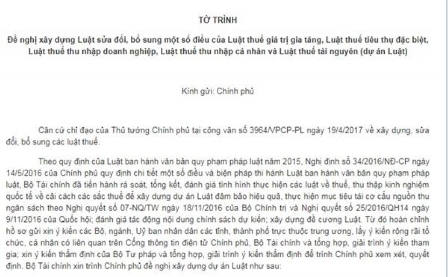

VCN- The Ministry of Finance has sent a Dispatch to Central Committee of Vietnam Fatherland Front, ministries, sectors, agencies under the Government, People’s Committee of provinces and cities, Vietnam Chamber of Commerce and Industry and business associations for consultation on outline of project of Law amending and supplementing a number of articles of the Law on Value Added Tax, the Law on Special Consumption Tax, the Law on Corporate Income Tax, the Law on Personal Income Tax and the Law on Severance Tax.

According to the Ministry of Finance, it completed the draft dispatch to the Government and draft outline for the development of Law amending and supplementing a number of articles of 5 tax laws. The Ministry of Finance required agencies to consult on proposed contents. Especially, the Ministry of Finance proposes that consultations shall be sent before August 29, 2017, for timely submission to the Government.

The Draft includes many important contents such as expanding the entities subject to Value Added Tax, increasing VAT from 10% to 12% by 2019, levying Special Consumption Tax on canned soft drinks, teas, coffee, and cigarettes (absolute tax rate). Addition, the Ministry of Finance also proposed to highly increase the tax rate for pick- up truck and impose tax rate for small cars under the localization rate, meaning that the domestically produced components will be exempted from tax.

Regarding Personal Income Tax, the Ministry of Finance proposes to impose tax rate from 10% to 30% for prize-winners and reduce the tax rate for high technology human resources and farmers participating in “big field” project.

For the Severance Tax, the drafting agency supplements regulation on Severance tax rate for natural water used for production hydroelectricity and Severance tax rate for resources exploited for export.

The amendments in Corporate Income Tax is that micro business (with total annual revenues of less than 3 billion VND) will be imposed a tax rate of 15%. Small and medium size businesses (with the average number of employees participating in social insurance, not more than 200 people and the total annual revenues from 3 billion to 50 billion VND) will be imposed a tax rate of 17%.

According to Ministry of Finance, the amendments of tax types must ensure the revenue growth of State budget in long term, meet requirements of tax policy reform and contribute to the orientation of production and consumption to create change in allocating sources and improving the investment environment and encouraging tax payers to expand production and business.

The Prime Minister assigned the Ministry of Finance to a chair and supplement a number of articles of 5 above tax laws to submit the Government for reporting to National Assembly Standing Committee for supplementation to the program of developing law and ordinance of National Assembly in 2018 under provisions of Law on the promulgation of the legal normative document.

On 18th August 2017, the Deputy Prime Minister Vuong Dinh Hue met with ministries and sectors to consult on the draft law. On 15th August, the Government Office issued a document announcing opinion of the Deputy Prime Minister on amendments and supplementations of above tax laws.

Also on 15th August 2017, the Ministry of Finance held a press conference to announce the mass media and immediately uploaded the main orientations of the project on the Portal.

By Hong Van/Ngoc Loan

Most Recent News

| Title | Category | Created On |

|---|---|---|

| Viet Nam Customs successfully organized a national workshop on illegal wildlife trade and risk management | News | 2026-01-28 10:57:09 |

| Strategic Trade Control Risk Management Dialogue | News | 2026-01-19 14:30:37 |

| Hội nghị Đối thoại về Quản lý Rủi ro Kiểm soát Thương mại Chiến lược | News | 2026-01-19 14:30:33 |

| The Department of Viet Nam Customs signed a Statement of Intent to enhance cooperation with the Australian Border Force | News | 2025-12-18 15:40:33 |

| The Department of Viet Nam Customs held a working meeting with the high-level delegation of the ASEAN-Europe Business Council and the European Business Association in Viet Nam | News | 2025-12-17 15:22:59 |

Search All News

|

A Quick Intro |

Search Trade Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feature Information

|

|

|

|

|

|

|

|

|

|

|

Information & Articles

|

|

|

|

|

|

|

|

|

|

|

|

Contact Us! If you cannot find what you require in this website please feel free to contact us. Click here to send us a message >>>

|