View Procedure

| Procedure Name | Procedure for certified true copying of the original customs declaration kept by the customs authority in the dossier of application for duty refund or duty cancellation |

|---|

| Description |

|

Category

|

Customs Clearance Procedure

|

|

Responsible Agency

|

Provincial Customs Department

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

- Law No. 107/2016/QH13 dated April 06th, 2016, on Export and Import duties;

-

Decree No. 134/2016/ND-CP dated September 01, 2016, guidelines for the Law on Export and import duties;

-

Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures; customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods

|

|

Processing time

|

-

If import/export procedures are initiated at the same Customs Sub-Department: Within 05 working days from the day on which the written request is received;

-

For other cases: Provincial/City Customs Departments shall reply/confirm in writing to the customs authority where the procedure for the customs declaration the organization/ individual declares as lost/missing on the not-duty-refunded status of that declaration: Within 05 working days from the day on which the written request is received.

|

|

Fee

|

|

Required documents

|

No

|

Type of documents

|

Note

|

|

1

|

Written declaration of the missing of copy kept by the taxpayer (of the customs declaration), requesting for certified true copying of the original customs declaration kept by the customs authority

|

01 original copy

|

|

2

|

Documents proving the lost/missing status of the customs declaration for duty refund

|

|

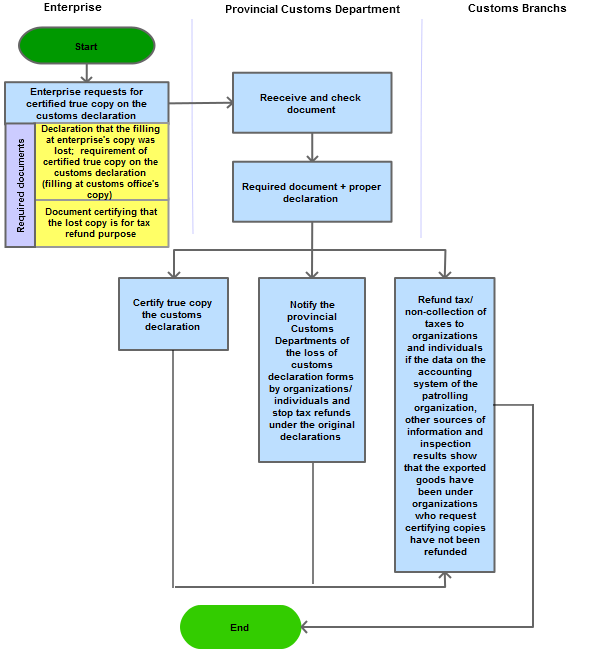

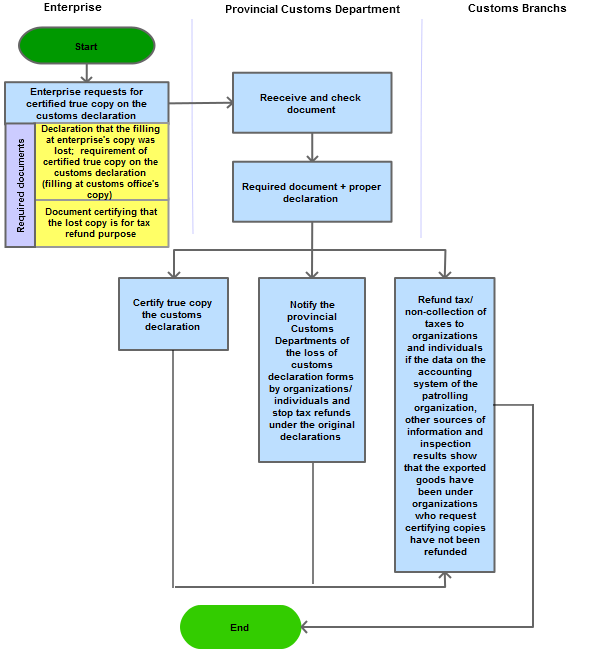

Process Steps

|

No

|

Contents

|

|

Step 1

|

The organization/individual possessing goods subject to duty refund according to the provisions of Article 114 Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Finance Ministry or subject to duty exemption applied to goods imported for processing contracts, when following procedures for tax refund or tax cancellation, if the submission of the original customs declaration is impossible, the certified true copy shall be accepted

|

|

Step 2

|

The Customs Division where the customs declaration is requested to make the certified true copy shall receive and examine the application and the certified true copy of the declaration+ If import/export procedures are initiated at the same Customs Sub-Department (except for cases of duty refund prescribed in Clauses 5, 7, 8 of Article 114 Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Finance Ministry:

++ The Customs Sub-Department where the import/export procedures for the shipment are settled shall (i) receive and examine the dossier of request and documents proving the lost/missing status of the customs declaration; (ii) conduct the certified true copying of the declaration and note on the declaration that "the declaration has been made into 01 certified true copy on dd/mm/yy";

+ For other cases:

++ The Customs Sub-Department where the procedures for the organization/individual declaring the lost/missing status of the customs declaration are settled shall: (i) receive the written request for certified true copying of the original customs declaration; (ii) make a written document requesting for Provincial/City Customs Departments to reply/confirm in writing that they have not settled (and did not settle) the duty refund or duty cancellation for the original of the customs declaration the organization/ individual declares as lost/missing; Provincial/City Customs Departments shall: (i) conduct the prescribed works, (ii) reply/confirm in writing

++ After receiving the replying/confirming document from the Provincial/City Customs Departments, the Customs Sub-Department where the procedures for certified true copying of the customs declaration are followed shall:

(i) examine the dossier of request and documents proving the lost/missing status of the customs declaration; (ii) conduct the certified true copying of the declaration and note on the declaration that "the declaration has been made into 01 certified true copy on dd/mm/yy";

|

|

Step 3

|

The Customs Division where the procedures for certified true copying of the customs declaration are followed shall send a written notice to Provincial/City Customs Departments on the application for certified true copying of the organization/individual; and that it has not settled (and did not settle) the duty refund or duty cancellation for the original of the customs declaration the organization/ individual declares as lost/missing.

|

|

Step 4

|

The customs authority responsible for tax refund shall perform prescribed tasks of inspection before tax refund; tax refund/non-collection of tax; and handling of violations (if any)

|

Requirements and conditions in following administrative procedures:

|

Goods eligible for tax refund as prescribed in Article 114 of Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance or exempt from import tax on goods serving execution of a processing contract.

|

Flow chat

|

|---|

| Category | Procedure |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |