| Description |

|

Category

|

Permit/Certificate

|

|

Responsible Agency

|

General Department of Customs

Address: Block E3 - Duong Dinh Nghe street, Yen Hoa, Cau Giay, Hanoi, Vietnam

Phone: (+844) 39440833 (ext: 8623)

Email: webmaster@customs.gov.vn

|

|

Legal basis of the Procedure

|

-

-

Decree No. 08/2015/ND-CP of the Government dated January 21, 2015 providing specific provisions and guidance on enforcement of the Customs Law regarding customs procedures, examination, supervision and control procedures.

-

Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

|

|

Processing time

|

-

Within 10 working days from the day on which valid and sufficient documents are received, the provincial Customs Department shall conduct examination steps and send the dossier to the General Department of Customs

-

Within a permitted period of 10 working days of receipt of the report, the General Department of Customs must complete appraising, reporting, and requesting the Minister of Finance to issue a decision of approval or notify the Customs Department and the applicant in writing if any of the prescribed conditions is not fulfilled.

|

|

Fee

|

VND 0

|

Required documents:

|

No

|

Type of documents

|

Note

|

|

1

|

Written request for relocation/transfer of ownership

|

01 original copy

|

|

2

|

Site plan of warehouse or storage yard

|

01 photocopy

|

|

3

|

Documents proving the ownership of the warehouse, storage yard

|

01 photocopy

|

Conditions:

|

Conditions for establishment of customs facility at port of import/export of inland goods (inland customs deport)

|

|

1

|

The customs facility is on the master plan for ICD system announced by the Prime Minister.

|

|

2

|

Have an area of no less than 10 hectare.

|

|

3

|

Meet the working standards of customs authorities, including main office, commodity inspection area, and equipment (screening machine, etc.), installation area and exhibit warehouse.

|

|

4

|

The depot area must have fences or walls to keep them separated from surrounding areas and must be equipped with surveillance cameras. Goods entering, leaving the depot area must be monitored by a computer system connected with the customs authority.

|

|

Conditions for establishment of customs facility outside checkpoint area

|

|

1

|

The customs facility is in the master plan of the Ministry of Finance for the network of customs facilities outside checkpoint area.

|

|

2

|

Have an area of no less than 01 (one) hectare

|

|

3

|

Meet the working standards of customs authorities, including main office, commodity inspection area, and equipment (screening machine, etc.), installation area and exhibit warehouse.

|

|

4

|

The depot area must have fences or walls to keep them separated from surrounding areas and must be equipped with surveillance cameras. Goods entering, leaving the depot area must be monitored by a computer system connected with the customs authority.

|

|

Procedures for establishment of ALS

|

|

1

|

ALSs shall be established in:

-

Areas adjacent to civil international airports;

-

Industrial parks, hi-tech zones, export-processing zones

-

The distance from the said areas to an civil international airport shall not exceed 50 km.

|

|

2

|

The minimum area is 2,000 m2 (including depot area and auxiliary works).

|

|

3

|

The ALS owner is a enterprise established under the law which has a system of storage for exported or imported goods in a civil international airport that is not longer than 50 km from the ALS.

|

|

4

|

Meet the working standard of customs authorities, including main office, commodity inspection area, and equipment (screening machine, etc.), installation area and exhibit warehouse.

|

|

5

|

The depot area is separated from surrounding areas by study fences; exported goods and imported goods are stored in separate places.

|

|

6

|

The owner has a system of accounting records and IT applications to manage the inventory. The warehouse must have a surveillance camera system that meet standards for supervision of goods inventory of the customs.

|

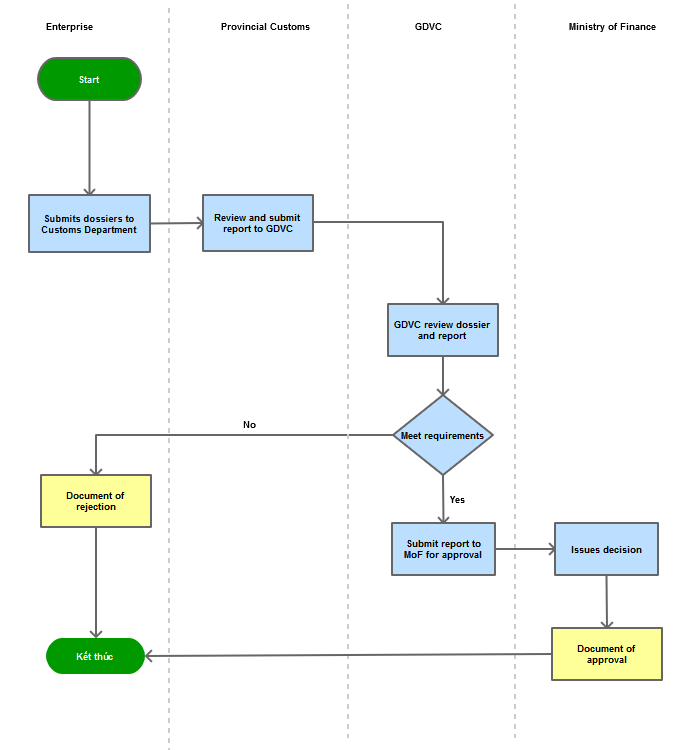

Process Steps

|

Step 1

|

The enterprise wishing to relocate or transfer the ownership of the facility, upon meeting prescribed requirements, can submit the dossier to the provincial/city Customs Department.

|

|

Step 2

|

After receipt of sufficient valid documents from the enterprise, the provincial/city Customs Department shall proceed to:

- Examine the dossier documents;

- Conduct physical examination of the depot area;

If the prescribed conditions are fulfilled, the provincial/city Customs Department shall send a report or proposal to the General Department of Customs to grant the decision to approve the relocation or transfer

|

|

Step 3

|

The General Department of Customs must complete appraising, reporting, and requesting the Minister of Finance to issue a decision on the relocation or transfer. If any of the condition is not fulfilled, the General Department of Customs shall notify the Customs Department and the applicant in writing.

|

|

Process Map:

|

|---|