| Description |

|

Category

|

Permit/Certificate

|

|

Responsible Agency

|

Provincial/city Customs Department

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

|

|

Processing time

|

-

Within 07 working days after receiving the complete and valid dossier

-

When verification is needed, this time limit is 15 working days counting from the date of receipt of the dossier (Department at provincial/city levels)

-

Within 05 working days at the General Department level.

|

|

Fee

|

VND 0

|

Required documents:

|

No

|

Type of documents

|

Note

|

|

1

|

Application for automobile and motorcycle import

|

01 original copy of the request for import

|

|

2

|

Valid foreign passport/Vietnamese passport

|

01 certified Vietnamese translation copy enclosed with the original for comparison

|

|

3

|

Permanent residence register

|

01 notarized copy

|

|

4

|

Automobile or motorcycle circulation registration paper or circulation deregistration paper

|

|

|

5

|

Bill of lading

|

01 original copy

01 photocopy

|

Requirements and conditions in following administrative procedures

|

No

|

Requirements:

|

|

1

|

An overseas Vietnamese citizen permitted to repatriate may import 01 used personal automobile.

|

|

2

|

The used automobile must be the one registered for circulation in the current residence country or the country where the Vietnamese works (not the residence country) before he/she is permitted to register permanent residence in Vietnam.

|

|

3

|

Imported automobiles must have been: registered for circulation for at least 6 months in the country where the overseas Vietnamese citizen works (not the residence country), and have run a distance of at least 10,000 km by the time of arrival at a Vietnamese port.

|

|

4

|

Motorcycles must be registered for circulation in the country where the overseas Vietnamese citizen resides or works before he/she is permitted to register permanent residence in Vietnam, with the time of permission to register permanent residence in Vietnam determined based on the permanent residence book granted by the police.

|

|

5

|

Motorcycles must be of types permitted for registration and circulation in Vietnam.

|

|

6

|

Imported motorcycles must be: within 3 years from the date of manufacture to the date of arrival at a Vietnamese port.

|

|

7

|

Imported automobiles must satisfy the requirements set in the Government’s Decree No. 187/2013/ND-CP of November 20, 2013, detailing the Commercial Law regarding international goods purchase and sale and goods purchase and sale agency, processing and transit with foreign countries, and in the Ministry of Transport’s Circular No. 31/2011/TT- BGTVT of April 15, 2011, prescribing the inspection of quality, technical safety and environmental protection of imported motor vehicles.

|

|

8

|

Imported motorcycles must satisfy the requirements set in the Ministry of Transport’s Circular No. 44/2012/TT-BGTVT of October 23, 2012, prescribing the inspection of quality, technical safety and environmental protection of imported motorcycles and mopeds and motors for the manufacture and assembly of motorcycles and mopeds.

|

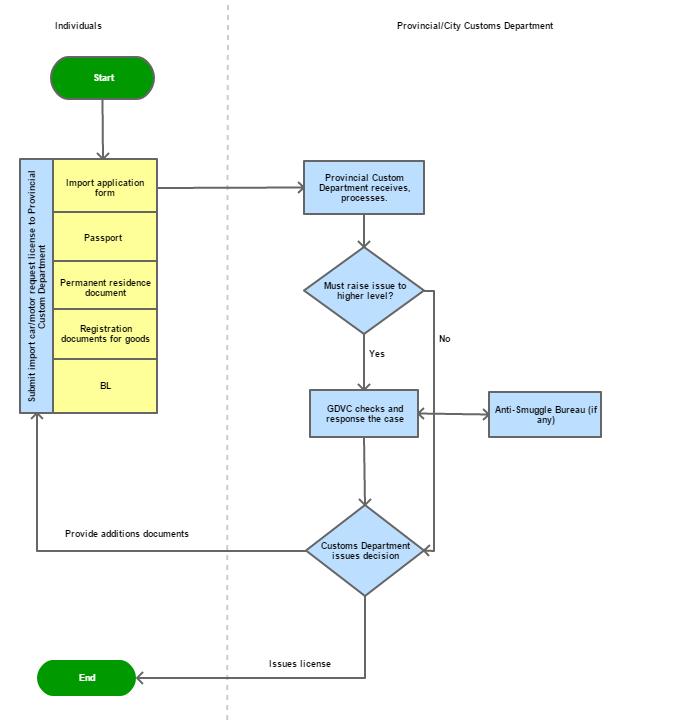

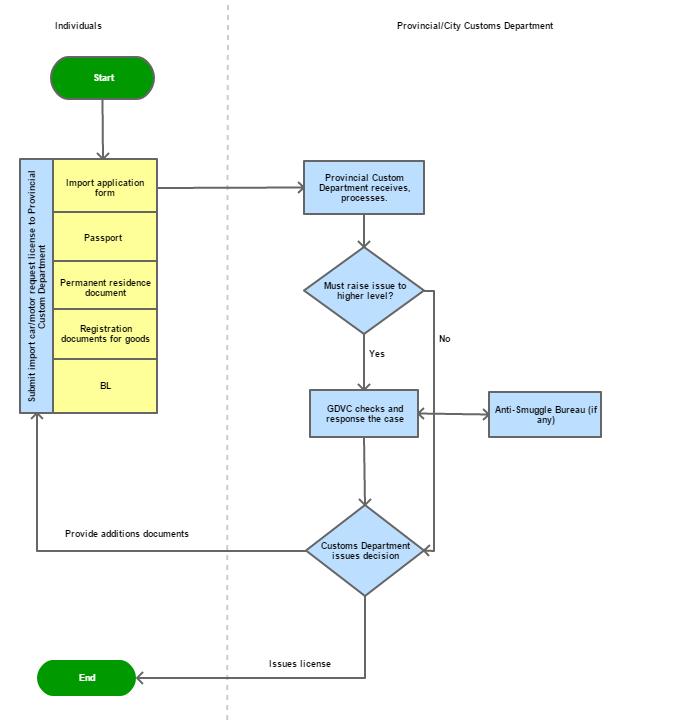

Process Steps

|

Step 1

Submit the application for grant of import permit

|

The applying individual shall submit the dossier of application for import permit of used automobiles as personal effects to the provincial/city Customs Department at the locality where the permanent residence book of the individual is registered.

|

|

Step 2

Receive, verify and submit the dossier to the General Department of Customs

|

Within 07 working days after receiving the complete and valid dossier (when verification is needed, this time limit is 15 working days counting from the date of receipt of the dossier - Department at provincial/city levels), the Department shall:

- Receive and examine the dossier

- Conduct verification measures at the request of the General Department of Customs and make an working report enclosed with the dossier.

- Submit the dossier to the General Department of Customs for consideration and decision.

|

|

Step 3

The General Department of Customs shall issue the decision

|

Within a permitted period of 07 working days of receipt of the report enclosed with the dossier from the provincial/city Department, the General Department of Customs shall complete the examination, co-ordinate with the Anti-Smuggling Investigation Department if required and request the in-charge leader of the Anti-Smuggling Investigation Department to issue a decision of approval/disapproval or request the provincial/city Customs Department to supplement required papers to the dossier or verify some contents.

|

Process Map:

|

|---|