View Procedure

| Procedure Name | Procedure for applying C/O |

|---|

| Description |

| Category |

License |

| Responsible Agency |

Ministry of Industry and Trade

Address: 54 Hai Ba Trung Str, Hoan Kiem District, Ha Noi, Viet Nam

Phone: (+844) 2220 5444

Email: co@moit.gov.vn

|

| Legal Basis of the Procedure |

- Decree 19/2006/ND-CP, Regulations detailing the Commercial Law regarding the origin of goods.

|

| Processing time |

- No later than 4 hours after receiving full required documents.

|

| Fee |

0 VND |

Documents required

|

STT

|

Tên hồ sơ |

Ghi chú |

|

1

|

Company profile |

01 Original

|

|

2

|

Business registration license |

01 Copy |

|

3

|

Applicant for applying C/O |

01 Original |

|

4

|

C/O form |

01 Original, 02 Copies |

|

5

|

Business Invoice |

01 Original |

|

6

|

Customs declaration form for export goods |

01 Original with company stamp |

|

7

|

Packing list |

01 Original |

|

8

|

Bill of Lading |

01 Copy with stamp |

|

9

|

Customs declaration form for imported goods |

01 Copy (in case of import material) |

|

10

|

Information of the manufacturing process |

01 Original (first time only) |

|

11

|

Other documents: Export permit license; Contract; Sample of raw materials, auxiliary materials or products for export; Or other documents proving the origin of the product. |

|

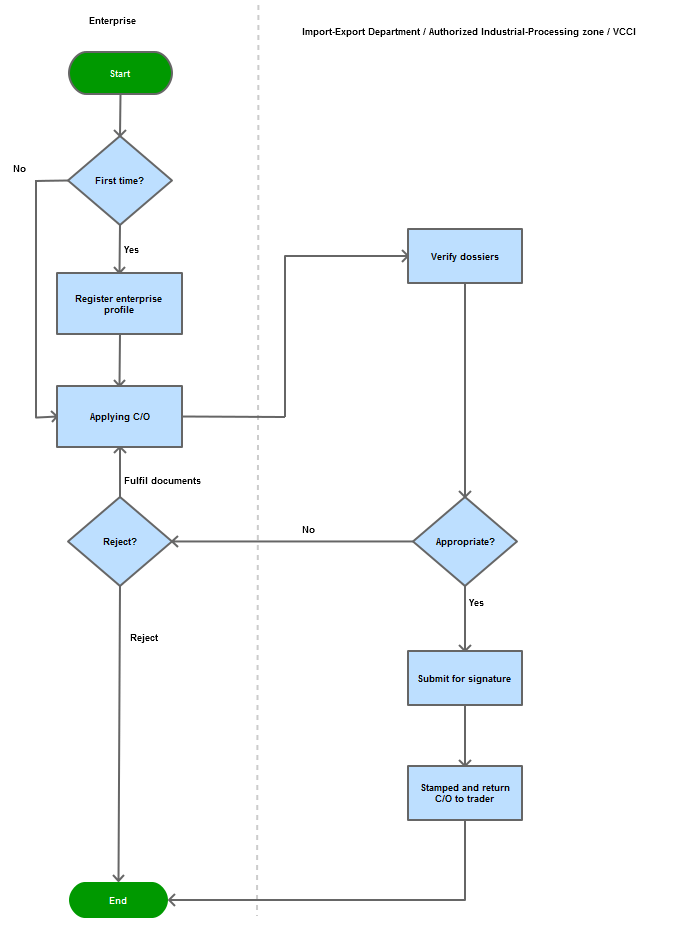

Process step

|

Step 1

|

Trader register the trader profile at the Regional Import/Export Management Bureau / Industrial Park / VCCI |

|

Step 2

|

Trader submit dossier to apply for C/O at the Regional Import/Export Management Bureau / Industrial Park / VCCI |

| Step 3 |

Regional Import/Export Management Bureau / Industrial Park / VCCI verifies if the dossier qualified or not and notifies trader about the acceptant to provide C/O, supplement dossier or refuse the dossier |

| Step 4 |

Staff executes further checks, enter data into computer system and submitted to the authorized person for issuance of C/O. |

| Step 5 |

The authorized person at the Regional Import/Export Management Bureau / Industrial Park / VCCI signs the C/O |

| Step 6 |

Officer at the Regional Import/Export Management Bureau / Industrial Park / VCCI seals, updates data and returns C/O to traders |

Process map:

|

|---|

| Category | Procedure |

|---|

Please customize this view

This procedure apply to theses Measures.