View Procedure

| Procedure Name | Procedure for transfering automobiles and motorbikes of subjects entitled to immunities and privileges in Vietnam |

|---|

| Description |

|

Category

|

Permit/Certificate

|

|

Responsible Agency

|

Provincial/city Customs Department

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

-

Customs Law No. 54/2014/QH13 dated June 23, 2014.

-

Decree No. 73-CP dated July, 30, 1994 of the Government on detailed regulations on the implementation of the Ordinance on the privileges and immunities of diplomatic representations, foreign consulates, and representative offices of international organizations in Vietnam.

-

Decision No. 53/2013/QD-TTg dated September 13, 2013, on temporary import, re-export, destruction and transfer of automobiles and motorbikes of entities eligible for privileges and immunities in Vietnam

-

Circular No. 19/2014/TT-BTC dated February 11, 2014 of the Ministry of Finance prescribing procedures for temporary import, re-export, destruction and transfer of automobiles and motorbikes of subjects entitled to privileges and immunities in Vietnam.

-

Decision No. 601/QD-BTC dated March 26, 2014 of the Ministry of Finance on correcting a number of Articles of the Circular No. 19/2014/TT-BTC dated February 11, 2014.

-

Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

|

|

Processing time

|

|

|

Fee

|

VND 0

|

Required documents:

|

No

|

Type of documents

|

Note

|

|

1

|

Transfer permit of the vehicle

|

|

|

2

|

Customs declaration

|

|

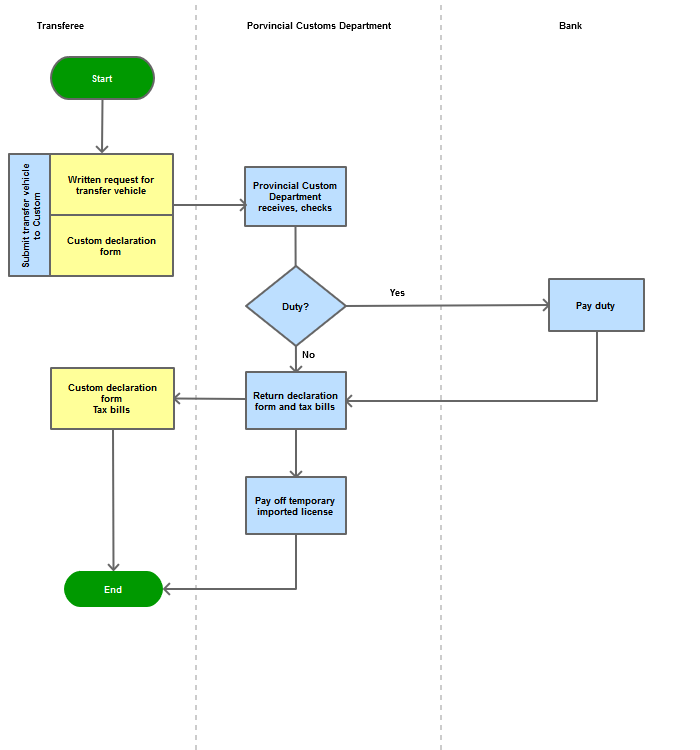

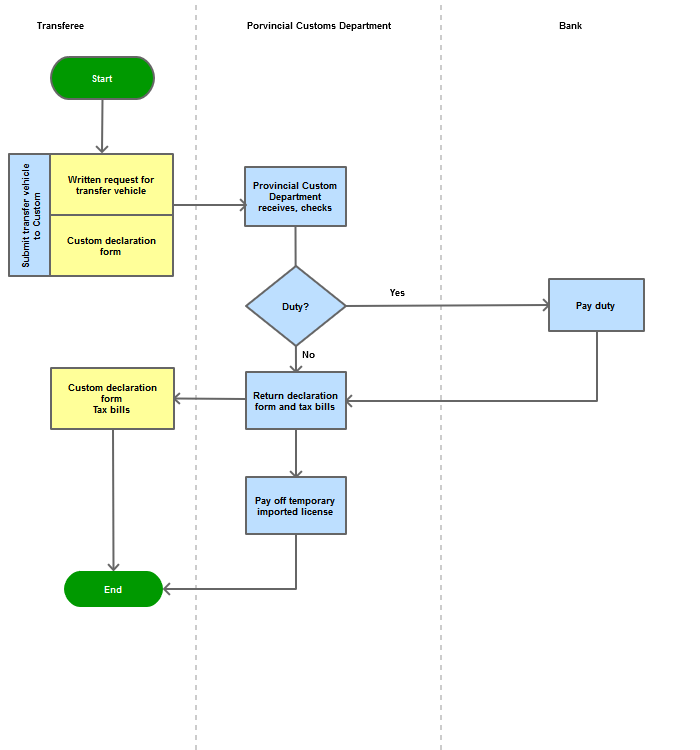

Process Steps

|

Step 1

Submit the application for grant of permit

|

The transferee of the vehicle shall submit the non-commercial import/export customs declaration (HQ/2011-PMD) to the customs authority

|

|

Step 2

Receive the dossier of papers, take required steps and make relevant decisions.

|

Based on vehicle transfer permit and customs declaration as well as the actual state of the vehicle, the provincial/city Customs Department shallo carry out transfer procedures (including the tax calculation and collection, except for those purchasing vehicles or receiving vehicles donated or given as gifts that are subjects or persons).

|

|

Step 3

.

|

The provincial/city Customs Department shall return one declaration (the copy kept by the declarant) and the tax receipt to the person carrying out the transfer procedures or person authorized to carry out the transfer procedures in accordance with law for carrying out procedures for vehicle registration; or collect copies of papers on payment into the state budget or of checks via the State Treasury (with the certification of the receiving State Treasury) or letter of authorization for via-bank payment from the person carrying out the transfer procedures or person authorized to carry out the transfer procedures in accordance with law.

|

|

Step 4

|

The provincial/city Customs Department shall liquidate the vehicle temporary import permit under regulations.

|

Process Map:

|

|---|

| Category | Procedure |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |