View Procedure

| Procedure Name | Customs procedures applied to incoming or outgoing shipments through free trade zones |

|---|

| Description |

|

Category

|

Customs Clearance Procedure

|

|

Responsible Agency

|

Customs Division

Phone:

Email:

|

|

Legal basis of the Procedure

|

-

Law on Customs No. 54/2014/QH13 dated June 23, 2014;

-

Decree No. 08/2015/ND-CP dated January 21, 2015 on guidelines for enforcement of the Law on Customs in terms of customs procedures, customs supervision and inspection;

-

Circular No. 38/2015/TT-BTC dated March 25, 2015 on customs procedures; customs supervision and inspection; export tax, import tax, and tax administration of exported and imported goods

|

|

Processing time

|

-

No later than two (02) working hours for dossier examination

-

No later than eight (08) working hours for physical examination of the shipment

-

No later than two (02) working days for physical examination of the shipment with various types and large quantities of goods.

|

|

Fee

|

VND 20,000

|

Required documents

|

No

|

Type of documents

|

Note

|

|

1

|

Customs declaration

|

|

|

2

|

Commercial invoices

|

01 photocopy

|

|

3

|

The bill of lading or equivalent transport documents if goods are transported by sea, air, railroad, or multi-modal transport as prescribed by law (unless goods are imported through a land checkpoint, goods traded between a free trade zone and the domestic market, imported goods carried in the luggage upon entry)

|

01 photocopy

|

|

4

|

Import license for goods requiring this license; Import license under tariff-rate quota:

|

01 original copy if partial shipments are not permitted, or 01 photocopy enclosed with a monitoring sheet if partial shipments are permitted

|

|

5

|

A notice of exemption from inspection or inspection result issued by a specialized inspection agency as prescribed by law

|

01 original copy

|

|

6

|

Value declaration: The declarant shall make the value declaration using the set form The cases in which the value declaration is required and the value declaration form are provided in the Circular of the Ministry of Finance on customs valuation of exported goods and imported goods;

|

send it to the System in digital form or submit 02 original copies to the customs authority (in case of paper-based customs declaration)

|

|

7

|

Certificate of Origin (Certificate of Origin or Self-Certified ROO documents)

|

01 original copy or electronic documents

|

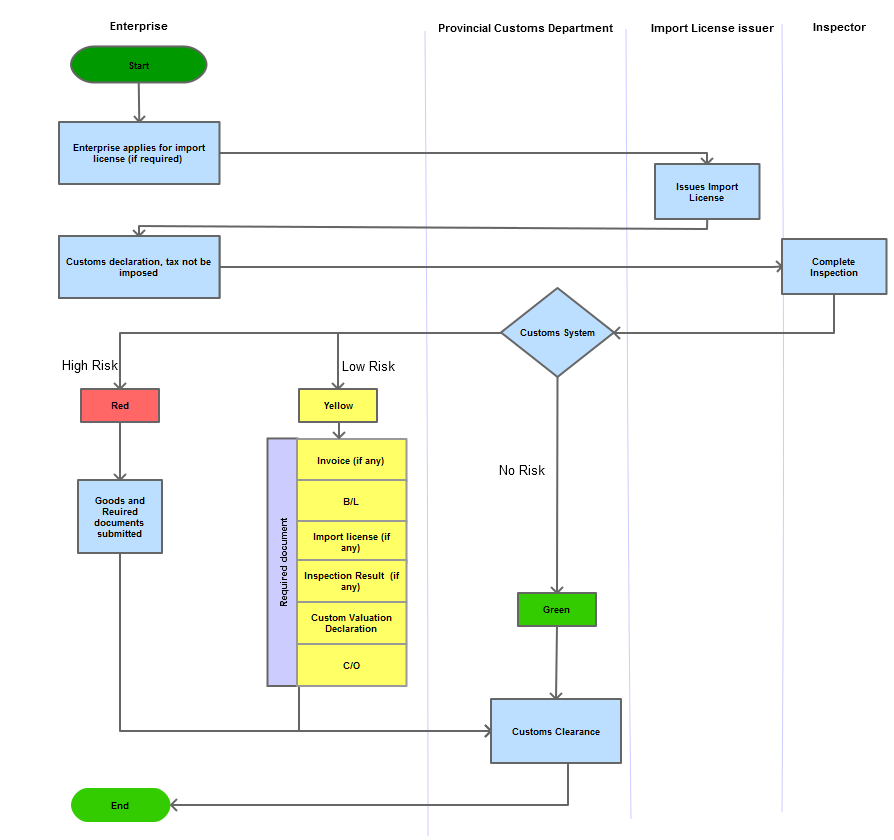

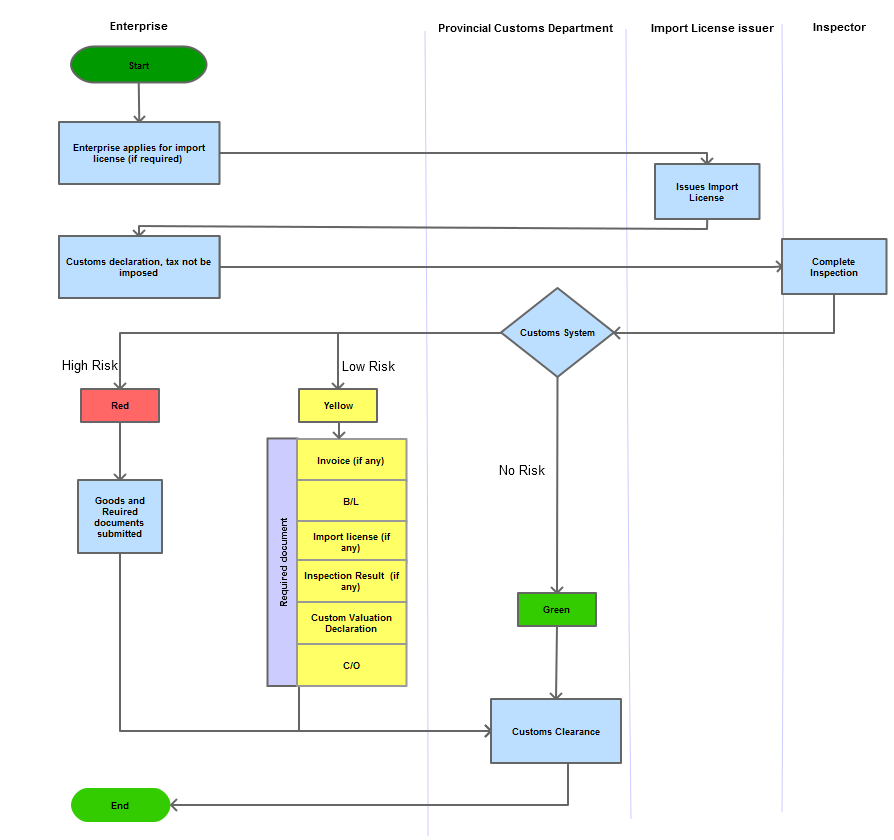

Process Steps

|

Step 1

|

Complete the customs declaration as specified for each import purpose at the Customs Division in charge of the free-trade zone, specifying the eligibility for goods that are not subject to tax (except for goods that are not eligible for import tax incentives).

|

|

Step 2

|

The Customs Authority shall examine customs dossier as stipulated by law.

|

Flow chat

|

|---|

| Category | Procedure |

|---|

Please customize this view

This procedure apply to theses Measures.