| Description |

|

Category

|

Certificate

|

|

Responsible Agency

|

General Department of Customs

Address: Block E3 - Duong Dinh Nghe street, Yen Hoa, Cau Giay, Hanoi, Vietnam

Phone: (+844) 39440833 (ext: 8623)

Email: webmaster@customs.gov.vn

|

|

Legal basis of the Procedure

|

Customs Law No. 54/2014/QH13 dated June 23, 2014.

Decree 08/2015/ND-CP Providing specific provisions and guidance on enforcement of the customs law on customs procedures, examination, supervision and control procedures

Circular 38/2015/TT-BTC on customs procedures, customs supervision and inspection, export tax, import tax, and tax administration applied to exported and imported goods

Circular 72/2015/TT-BTC Regulating on application of priority policy in customs procedures, customs inspection and supervision for exported and imported goods of enterprises.

|

|

Processing time

|

Within 45 working days after receiving the complete and valid dossier.

In complex situation, 1 time extend is not more than 30 days

|

|

Fee

|

VND 0

|

Required documents:

|

No

|

Type of documents

|

Note

|

|

1

|

The written request under the form 02a/DNUT Circular 72/2015/TT-BTC

|

01 original

|

|

2

|

Audited financial statements of the last 02 fiscal years

|

01 copy

|

|

3

|

The audit reports of the last two (02) fiscal years

|

01 copy

|

|

4

|

The inspection conclusions of the last 02 (two) years (if any)

|

01 copy

|

|

5

|

The description of internal management system of the enterprise which describes fully the processes to manage, monitor, control its entire operation, control of security and safety of its supply chain of exported and imported goods

|

01 original

|

|

6

|

The commendation certificate, quality certificate (if any)

|

01 copy

|

|

The investor who wishes to apply the priority policy for major investment project agreed by the Prime Minister before it is licensed investment in fundamental construction phase shall submit an application to the General Department of Customs. The application shall include:

|

|

1

|

The written request for application of priority policy and the commitment to carry out the project on schedule under the Form 02b/DNUT Circular 72/2015/TT-BTC

|

01 original

|

|

2

|

The investment certificate, economic and technical report

|

01 copy

|

Conditions for application of priority policy

|

Compliance with customs legislation and tax legislation

|

|

Over the last 02 consecutive years before the day on which the enterprise submits an application for recognition of prioritized enterprise, the enterprise did not commit any of the follow tax offences and customs offences which results in penalties:

1. Acts of tax evasion, tax fraud; smuggling and illegal transportation of goods across the border;

2. Administrative customs offences which result in the form and level of penalties beyond the competence of the Director of Sub-department of Customs and people holding an equivalent title;

3. A customs broker may only apply priority policy if the number of its declarations that incur administrative penalties for tax/customs offence by the Director of the Sub-department of Customs (or a person holding an equivalent title) does not exceed 0.5% of the total number of declarations that have undergone customs procedures.

4. Priority policy may only be applied if there is no overdue tax

|

|

Required export and import turnover

|

|

1. The enterprise earns at least USD 100 million in annual turnover from import, export.

2. The enterprise earns at least USD 40 million in annual turnover from export of goods manufactured in Vietnam.

3. The enterprise earns at least USD 30 million in annual turnover from export of goods being agriculture and aquatic products manufactured or grown in Vietnam.

4. The annual number of customs broker’s declarations undergone customs procedures is at least 20,000 declarations.

Export and import turnover specified in Clauses 1, 2, 3, 4 of this Article is an average turnover of 02 (two) last consecutive years before the date on which the enterprise submits a written request for consideration, excluding turnover from entrusted export and import.

5. The required export and import turnover mentioned above shall not be applied to the enterprise recognized as a high-tech enterprise by the Ministry of Science and Technology under the provisions of the Law on High Technology.

|

|

Electronic customs procedures and electronic tax procedures

|

|

Electronic customs procedures, electronic tax procedures must be followed; there must be export/import management software programs meeting requirements of the customs authority

|

|

Payment for exported and imported goods

|

|

Payment for export and import consignments is made through banks as stipulated by the State Bank. Enterprises shall notify the customs authority the account number and the list of transaction banks

|

|

Internal management system

|

|

An enterprise’s internal management system is considered satisfactory if it satisfies the following conditions:

1. The enterprise conducts and maintains processes to manage, monitor, and control its entire operation;

2. The enterprise has measures and instruments, internal management process ensuring the safety and security of supply chain of exported and imported goods as follows:

a. Monitor the transport process of goods from enterprises to ports and from ports to enterprises;

b. Inspect safety of containers before they are loaded onto the vehicles;

c. Supervise at important positions: Fences, entrances and exits, warehouses, manufacturing areas, administrative areas;

d. Assign employees to enter and work in the areas suitable for their tasks;

e. Control security of information technology systems;

f. Ensure staff security.

|

|

Good compliance with legislation on accounting, auditing

|

|

Accounting standards must be applied as prescribed by the Ministry of Finance;

The annual financial statement must be audited by an auditing company that is qualified for providing audit services in accordance with the law on independent audit. Auditor’s opinion on the financial statements mentioned in the audit reports must be an unqualified opinion according to the audit standards in Vietnam

|

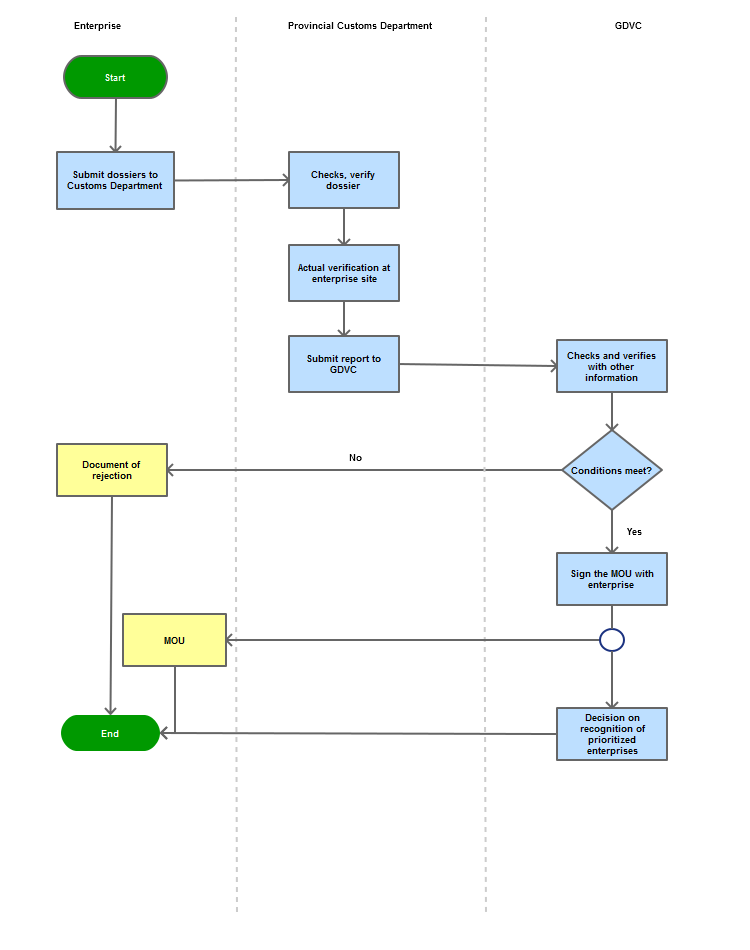

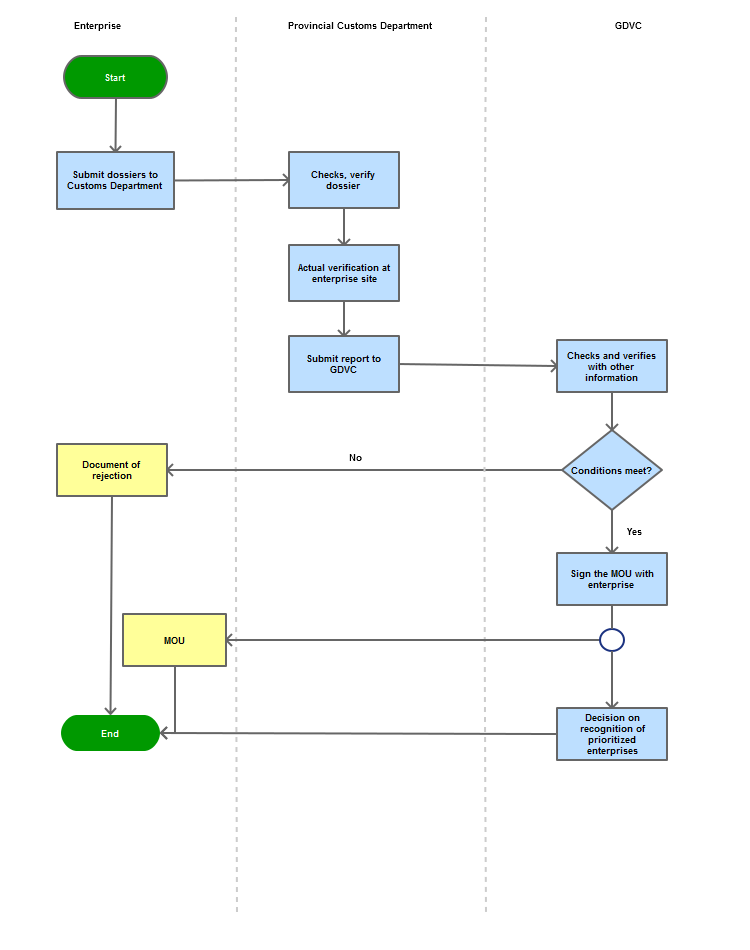

Process Steps

|

Step 1

|

Enterprises submit dossier to Provincial Customs Department where enterprise’s headquarter located.

|

|

Step 2

|

Customs Departments in provinces receives and checks dossier

|

|

Step 3

|

Customs Departments in provinces conduct the on-site inspection and submit report to GDVC

|

|

Step 4

|

GDVC verifies report and other information

|

|

Step 5

|

Sign the MoU with enterprise if conditions for application of priority policy and issues the recognition of prioritized enterprises

|

Process Map:

|

|---|