View Procedure

| Procedure Name | Procedure for transferring of the tax-exempt temporarily imported motor vehicles and motorcycles |

|---|

| Description |

|

Category

|

Permit/Certificate

|

|

Responsible Agency

|

Provincial/city Customs Department

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

Customs Law No. 54/2014/QH13 dated June 23, 2014.

Decree 187/2013/ND-CP detailing implementation of the Commercial Law with respect to international purchases and sales of goods; and activities of agency for sale and purchase, processing and transit of goods involving foreign parties

Decree 08/2015/ND-CP of the Government dated January 21, 2015 providing specific provisions and guidance on enforcement of the Customs Law regarding customs procedures, examination, supervision and control procedures.

Circular 143/2015/TT-BTC stipulating the procedure for customs clearance and management of motor vehicles, motorcycles of entities granted permission for import or temporary import for non-commercial purposes

Circular 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

|

|

Processing time

|

Within 15 working days

|

|

Fee

|

VND 20,000

|

Required documents:

|

No

|

Type of documents

|

Note

|

|

1

|

The written request for vehicle transfer (specifying information about vehicles and institutional or individual transferees)

|

01 original copy with certification given by the governing body in which the personal background of applicants must be verified

|

|

2

|

Notification of revocation of registration, license plate number of motor vehicles and motorcycles issued by the Police authority

|

01 original

|

|

3

|

Written confirmation of term of office of in Vietnam granted by the governing agency (applicable to entities stipulated in Clause 1, 2 and 3 Article 2 Circular 143/2015/TT-BTC)

|

01 copy

|

|

4

|

Customs declaration of import or temporary import of motor vehicles or motorcycles sealed with “sealed for re-export or assignment”

|

01 copy with certification of the Customs Sub-department in charge of import or temporary import procedures

|

|

5

|

Customs declaration of imported goods issued together with the Circular 38/2015/TT-BTC

|

|

|

6

|

Documents stating vehicle purchase and sale transactions between vehicle owners and transferees

|

|

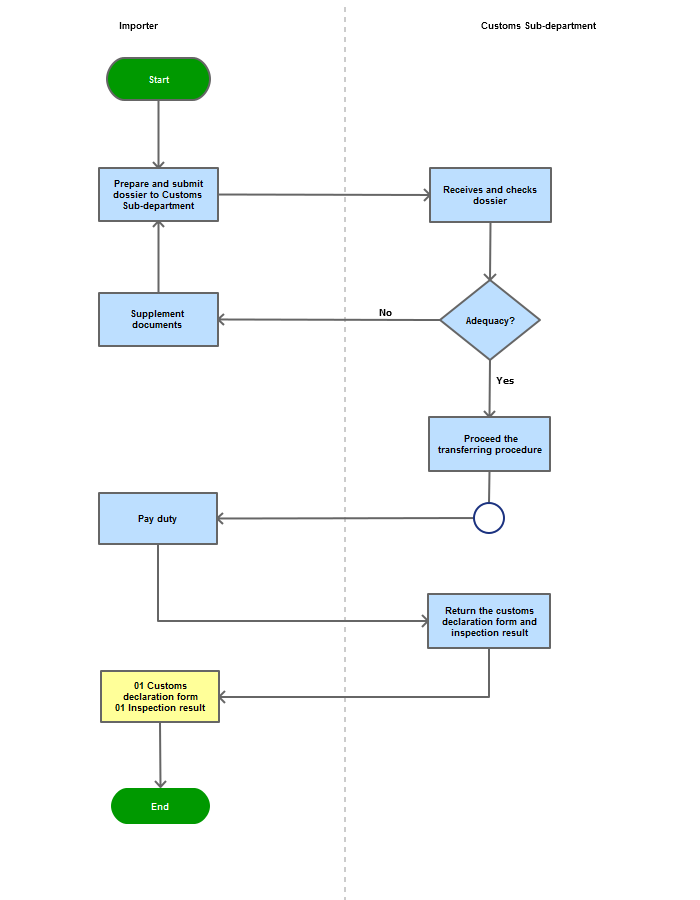

Process Steps

|

Step 1

|

Importer, temporary importer prepare and submit dossiers to Customs Sub-department affiliated to the Customs Department of cities, provinces where import and temporary import permits are issued.

|

|

Step 2

|

Customs Sub-department check the adequacy and legitimacy of dossiers. Provides guidance to supplement documents are not adequacy

|

|

Step 3

|

Customs Sub-department execute the transferring procedure. Return 01 customs declaration of importing commodities; 01 copy of the inspection result

|

Process Map:

|

|---|

| Category | Procedure |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |