View Procedure

| Procedure Name | Customs procedure for goods brought from bonded warehouses to inland areas or imported into non-tariff zones |

|---|

| Description |

|

Category

|

Permit/Certificate

|

|

Responsible Agency

|

Local Customs Department

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

-

-

Decree 08/2015/ND-CP providing specific provisions and guidance on enforcement of the Customs Law regarding customs procedures, examination, supervision and control procedures.

-

Circular 38/2015/TT-BTC on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

-

Circular 106/2016/TT-BTC guiding customs procedures for exports and petroleum imports, raw material for making gasoline; preparation activities, convert various types of petroleum fuel in the bonded warehouse (applied if goods is related to petroleum)

|

|

Processing time

|

|

|

Fee

|

VND 20,000

|

Required documents:

|

No

|

Type of documents

|

Note

|

|

1

|

Form 29/DSCT/GSQL in Annex V (for goods transported in containers)

or list of goods using Form 30/DSHH/GSQL in Annex V (for other goods) of Circular No. 38/2015/TT-BTC

|

|

Conditions:

|

No

|

Requirements:

|

|

1

|

Commodities stored at the bonded warehouse which are considered as those required to be re-exported under the decision made by competent regulatory agencies shall not be allowed to re-enter into the Vietnam’s market.

|

|

2

|

The following commodities/goods shall not be allowed to te brought into bonded warehouse from inland areas:

-

Commodities subject to border-gate import procedures.

-

Commodities included in the List of import goods prohibited from border-gate transfer issued by the Government's Prime Minister, except for commodities being materials/supplies, machinery, and equipment imported for inward processing; materials and supplies imported for manufacturing of products in Vietnam.

|

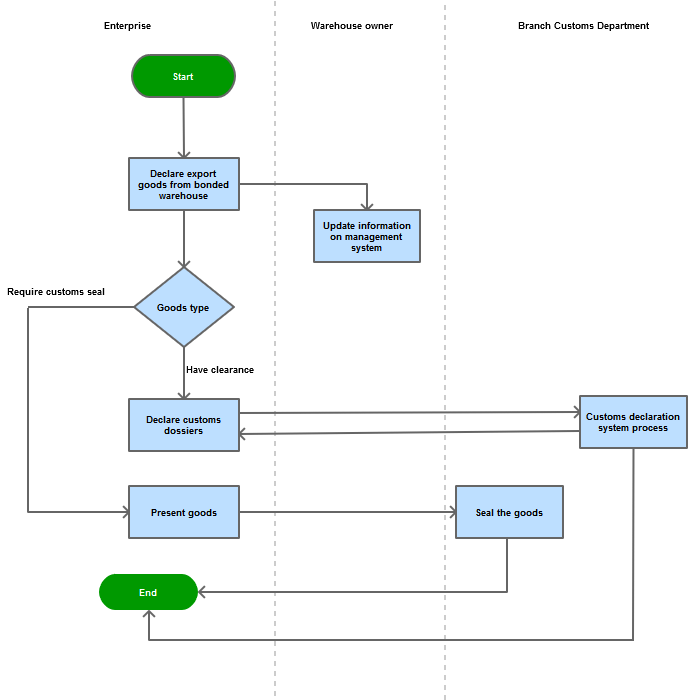

Process Steps

|

Step 1

|

Submit the customs declaration for commodities moved out of the bonded warehouse to the in-charge customs authority.

Specifically: The bonded warehouse owner/proprietor shall update information on arrival of commodities on the System of the customs authority and send the information to the customs authority in charge of the bonded warehouse for management and supervision.

|

|

Step 2

|

Perform the following steps:

-

Provide information about number of customs declaration, list of containers using Form No. 29/DSCT/GSQL in Annex V (for goods transported in containers) or list of goods using Form No. 30/DSHH/GSQL in Annex V (for other goods) of Circular No. 38/2015/TT-BTC or notice of approved transport declaration shall be provided for the port/warehouse/depot operator at the checkpoint, seaport, international airport, ALS, or the customs authority at the checkpoint.

The declarant shall print out the list of containers:

-

With regard to imported goods moved outside the port or checkpoint area and have to be sealed by the customs as prescribed in Clause 3 of Article 52 Circular No. 38/2015/TT-BTC:

+ Present the goods for the customs authority to seal;

+ Transfer the goods to the Sub-department of Customs to which goods are transported to carry on customs procedures as prescribed;

+ Preserve the status quo of the goods and the customs seal according to applicable regulations.

-

If the port/warehouse/depot operator does not have an IT system meeting standards for management, supervision of exported or imported goods moved in or out of the port or depot area, the declarant shall provide information about the number of declaration, list of containers, list of goods for the customs authority.

|

Process Map:

|

|---|

| Category | Procedure |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |