View Procedure

| Procedure Name | Customs procedure for goods brought into or out of tax suspension warehouses |

|---|

| Description |

|

Category

|

Permit/Certificate

|

|

Responsible Agency

|

Local Customs Department

Address:

Phone:

Email:

|

|

Legal basis of the Procedure

|

-

Articles 61, 62, 63 of Customs Law No. 54/2014/QH13 dated June 23, 2014.

-

Decree No. 08/2015/ND-CP of the Government dated January 21, 2015 providing specific provisions and guidance on enforcement of the Customs Law regarding customs procedures, examination, supervision and control procedures.

-

Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

|

|

Processing time

|

|

|

Fee

|

VND 20,000

|

Required documents:

|

No

|

Type of documents

|

Note

|

|

1

|

The electronic customs declaration for import goods on the electronic customs declaration software or the paper-based Form according to Form HQ/2015/NK in Annex IV Circular No. 38/2015/TT-BTC.

|

02 original copies (paper-based declaration form)

|

|

2

|

Commercial invoices (if the buyer has to pay the seller)

|

01 photocopy

|

|

3

|

Bill of lading and transport documents with equivalent validity

|

01 photocopy

|

|

4

|

Import license

|

01 original copy or 01 photocopy enclosed with the đdeduction monitoring sheet

|

|

5

|

Notification of exemption from inspection or of inspection results

|

01 original copy

|

|

6

|

Validation declaration

|

02 original copies (paper-based declaration form)

|

|

7

|

Certificate of Origin

|

01 original copy or a copy made in electronic form

|

Process Steps

|

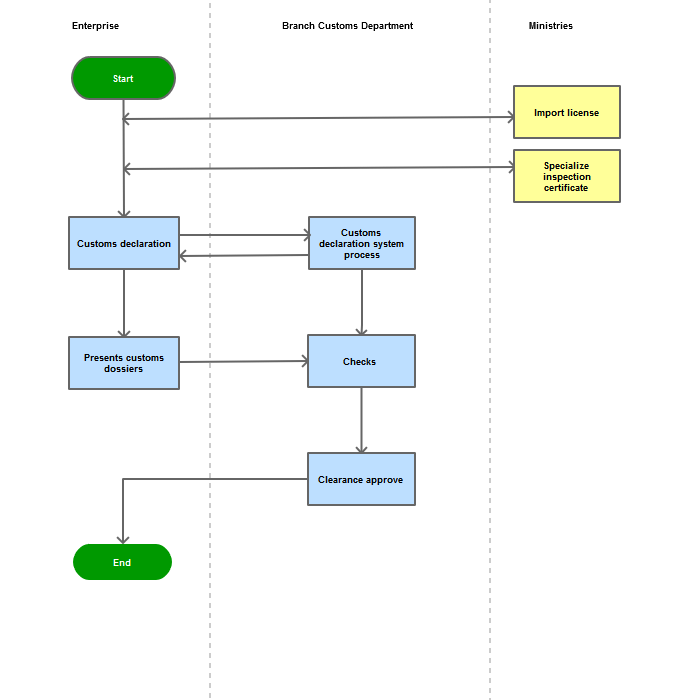

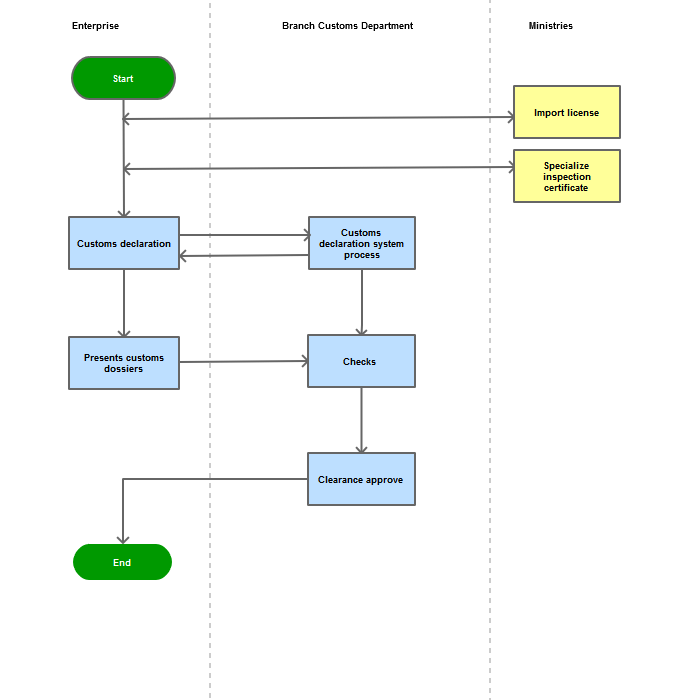

Step 1

|

The enterprise shall perform customs procedures for import of materials/supplies.

|

|

Step 2

|

Information on the customs declaration shall be automatically checked by the System to make sure conditions for customs declaration registration are satisfied.

In case of paper-based customs declaration, the customs official shall check the conditions for registration of customs declaration and documents enclosed with the customs dossier.

|

|

Step 3

|

According to the decision on customs inspection which is automatically notified by the System, the customs official shall: Accept information on the customs declaration and decision on customs clearance.

Examine related documents included in the customs documentation of customs declarations

|

|

Step 4

|

The customs authority shall receive, register, examine the customs dossier and make certification of goods passing through the customs controlled area on the System.

|

Process Map:

|

|---|

| Category | Procedure |

|---|

Please customize this view

This procedure apply to theses Measures.