| Description |

|

Category

|

Customs clearance

|

|

Responsible Agency

|

Local Customs Department

Phone:

Email:

|

|

Legal basis of the Procedure

|

-

Customs Law No. 54/2014/QH13 dated June 23, 2014.

-

Decree No. 08/2015/ND-CP of the Government dated January 21, 2015 providing specific provisions and guidance on enforcement of the Customs Law regarding customs procedures, examination, supervision and control procedures.

-

Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

-

Circular No. 274/2016/TT-BTC dated November 14, 2016, on the rate, collection, submission, management and use of the customs fees and the charges on goods and vehicles in transit.

-

Circular No. 69/2016/TT-BTC dated May 6, 2016 of the Ministry of Finance regulating customs procedures for import, export, temporary import for re-export and transit of petrol and oil, chemicals and gases; importation of raw materials for producing and preparing or outward processing of petroleum and gas; import and export of crude oil and other imports, exports for petroleum industry.

|

|

Processing time

|

-

Within 02 hours for examination of dossier.

-

Within 08 hours for examination of goods.

-

Within 02 working days for shipment in large quantities and of various types

|

|

Fee

|

- 20,000 VND/Declaration form

|

Required documents

|

Category

|

No

|

Type of documents

|

Note

|

|

|

1

|

Customs declaration

|

|

|

2

|

Commercial invoices

|

01 photocopy

|

|

3

|

Bill of lading or another transportation documents of equivalent validity, if cargoes are conveyed by means of sea

|

|

|

4

|

Quality assessment registration, Registration for Quality Inspection of Goods on the List of imports subject to state quality inspection

|

|

|

5

|

Sale contract (for temporary imports for re-exportation)

|

|

|

6

|

In case the trader lodges the first customs declaration at the Customs Authority, the following documents are required (except for exportation or re-exportation of petrol and oil to entities prescribed in point b, clauses 4 and 5 of the Decree No. 83/2014/ND-CP, and clause 3, Article 19 and clause 2, Article 35 of the Decree No. 19/2016/ND-CP):

g.1) Petroleum import and export license 01 photocopy

g.2) Certificate of Eligibility for gas importation/exportation or equivalent documents 01 photocopy

g.3) Minimum petrol and oil import quota granted by the Ministry of Industry and Trade 01 photocopy

h) Export license (where it is required) 01 original copy

|

In case of application of the national single-window system, the disciplinary State regulatory authority shall electrically send documents specified in point’s b, c, g and h of this clause via the National single-window system, the declarant shall be exempted from submission of such documents for customs procedures.

If a shipment must be declared on multiple declarations or imported goods serve multiple purposes, have the same bill of lading and invoice, declared on multiple invoices by purpose at the same Customs Authority, the declarant shall only submit 01 customs dossier (if paper documents are submitted) and write “chung chứng từ với tờ khai số … ngày …” (“in the same set with declaration No. …. Dated …..

|

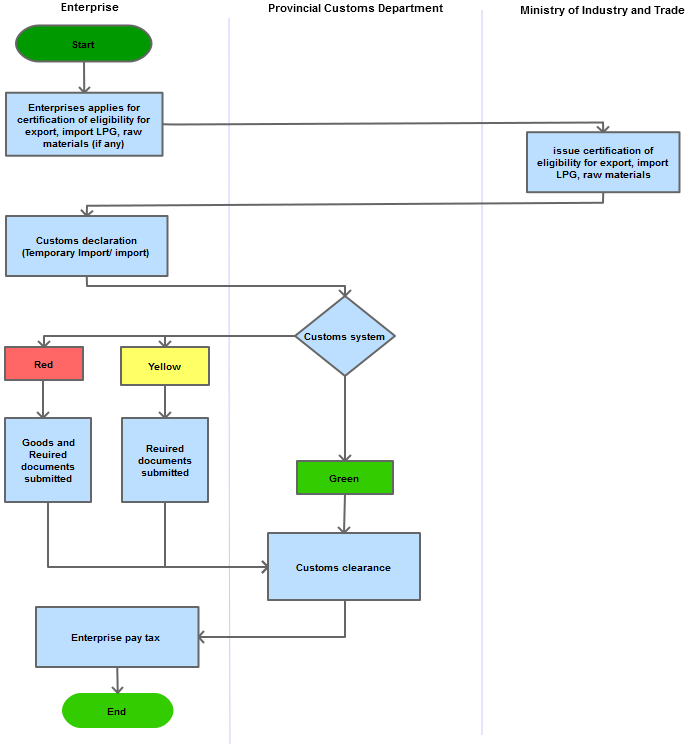

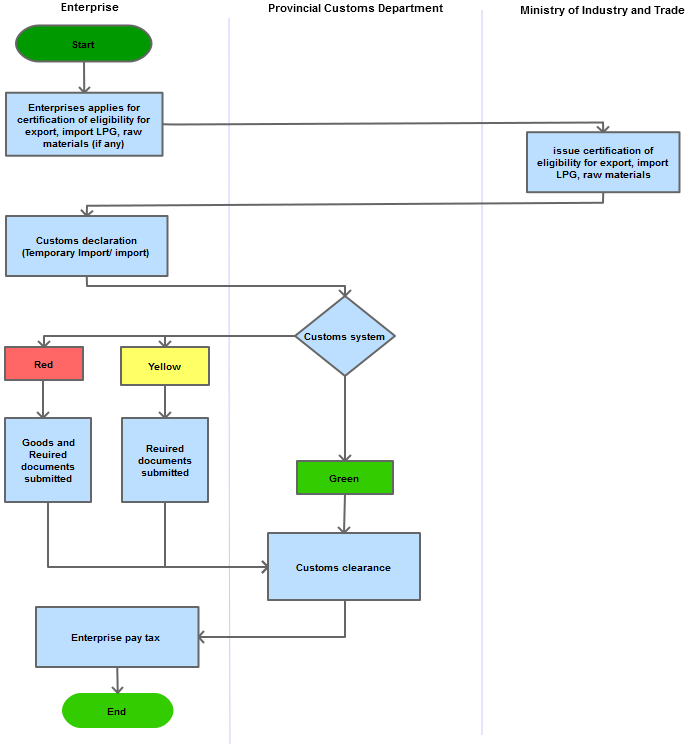

Process Steps

|

Step 1

|

The trader shall submit a dossier of application for settlement of customs procedures for temporarily imported petrol and oil, chemicals and gases.

|

|

Step 2

|

Examine the dossier (if any photocopy paper is found questionable, the Customs Authority shall request the trader to surrender the original one for examination and comparison); supervise the pumping of petrol and oil, gases, chemicals and raw materials and take samples for state quality inspection (for cases on the List of imports subject to state quality inspection); determine and collect taxes; certify customs clearance for the shipment.

|

|

Step 3

|

The trader shall pay the prescribed taxes before putting the imported petrol and oil, chemicals, gases, and raw materials into use; before putting the petrol and oil, chemicals, gases on maintenance.

|

Requirements and conditions in following administrative procedures:

-

Reserve the status quo of imported petrol and oil, chemicals or gases (both old and new imports, if any) during the waiting period for quality inspection result as stipulated in clause 3, Article 4 of Circular No. 69/2016/TT-BTC.

-

Follow clause 3, Article 4 hereof in case the quality of imported petrol and oil, gases or chemicals is unsatisfactory according to the quality inspection result.

-

Follow the penalty imposed by the customs authority in case of violations.

|

|---|