View Procedure

| Procedure Name | Customs procedure for imported goods on which tax has been paid and goods produced in Vietnam and for sale at duty-free shops |

|---|

| Description |

|

Category

|

Permit/Certificate

|

|

Responsible Agency

|

Local Customs Department

Address: Block E3 - Duong Dinh Nghe street, Yen Hoa, Cau Giay, Hanoi, Vietnam

Phone: (+844) 39440833 (ext: 8623)

Email: webmaster@customs.gov.vn

|

|

Legal basis of the Procedure

|

-

-

Decree 08/2015/ND-CP of the Government dated January 21, 2015 providing specific provisions and guidance on enforcement of the Customs Law regarding customs procedures, examination, supervision and control procedures.

-

Circular 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance on customs procedures, customs supervision and inspection; export tax, import tax, and tax administration applied to exported and imported goods.

-

|

|

Processing time

|

|

|

Fee

|

|

Required documents:

|

No

|

Type of documents

|

Note

|

|

1

|

Customs declaration

|

01 original copy

|

|

2

|

Contracts for the sale of goods or documents of equal legal value with contracts |

01 original copy (if any)

|

| 3 |

Commercial invoice |

01 photocopy |

| 4 |

Bill of lading |

01 photocopy |

| 5 |

Export permit (if any) |

|

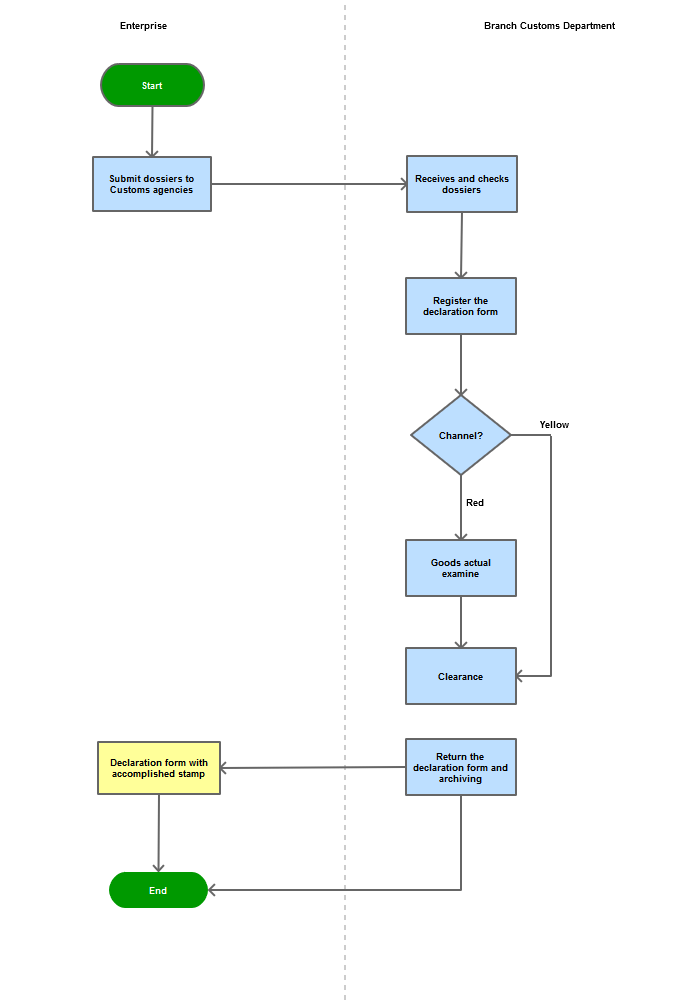

Process Steps

|

Step 1

|

The trader selling duty free goods shall prepare a dossier and submit it to the customs authority

|

|

Step 2

|

The customs authority shall receive and examine the dossier; examine the validity of the dossier and registration of customs declaration. Examine the dossier and certify customs clearance for the shipment of goods exempted from inspection

|

|

Step 3

|

Conduct physical inspection of goods and certify customs clearance for the shipment of goods subject to physical inspection

|

|

Step 4

|

Confirm the customs clearance in the system

|

Process Map:

|

|---|

| Category | Procedure |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| No results found. |